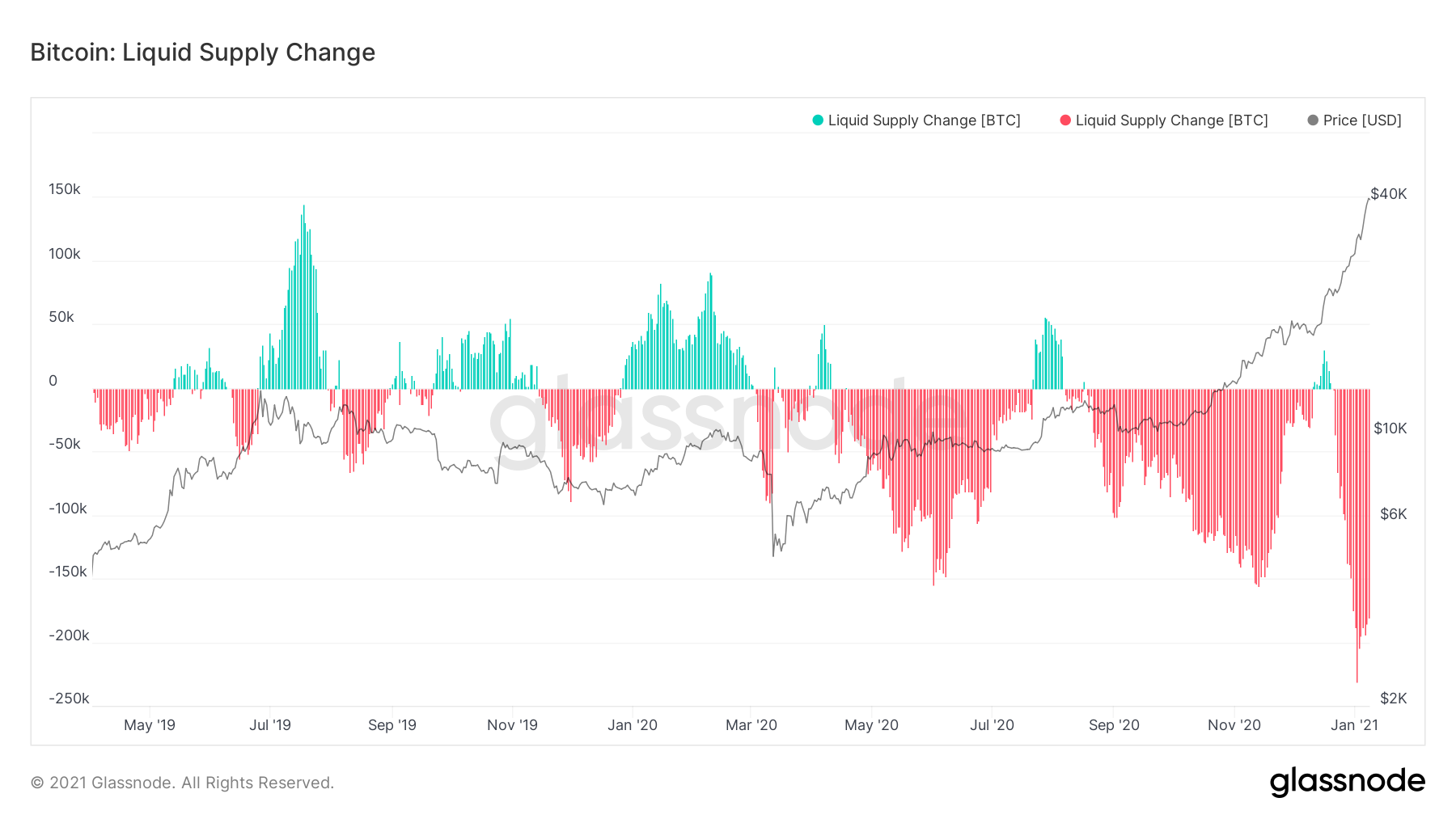

270,000 Bitcoins Move Off Exchanges in the Past 30 Days

2 min readThe end of 2020 saw a meteoric rise for Bitcoin, but prices in the new year have started to mellow out and experience less volatility.

Although prices have begun to consolidate a bit, more and more BTC are leaving exchanges for cold storage.

This metric, though ambiguous, could signify that investors are less interested in taking positions and prefer to move their BTC off exchanges so it can remain safer in cold wallet storage.

Data collected by Glassnode, an on-chain data analysis platform, shows that a whopping 270,000 bitcoins worth approximately $9 billion at current prices, has moved off exchanges and into cold storage in the last month.

Exchange Liquidity is Drying Up

As more cryptocurrencies like Bitcoin are taken off exchanges and put into cold storage for longer-term holding, the availability of the asset on exchanges continues to diminish. This makes sense logically, as there is only a finite supply of Bitcoin. The more that is stored away, the less that is available to be traded.

If this trend continues the entire industry could one day face a sell-side crisis with a noticeable lack of liquidity. This isn’t just a problem Bitcoin is facing — other cryptocurrencies are going through potential liquidity problems as well.

This past week, Ethereum saw its lowest exchange supply ratio since 2018, signaling that users have moved to storing and staking their ETH.

Institutional Demand Effect

Although some cryptocurrencies like Ethereum have seen supply cycles like this before, it’s never been experienced by Bitcoin at this level. This is one of the reasons many analysts think the current cryptocurrency market bull run is fundamentally different from what was seen in 2017.

Before 2020, institutional investments in Bitcoin were minuscule, as most companies didn’t want to bet on such a volatile asset. After the global, social, and financial problems faced following the outbreak of the COVID-19 pandemic, institutional investors finally started to look at Bitcoin as a real hedge against inflation and government incompetence.

This idea was largely pioneered by Bitcoin bulls like Michael Saylor, the CEO of Microstrategy who invested over $1 billion of his company’s treasury reserve assets into Bitcoin. This new outlook of Bitcoin as a better store of value than gold has driven a whole new wave of interest in the asset.

As more institutions clamor to purchase their Bitcoin, supplies will be sucked off exchanges and into the deep pockets of these institutions.

The post 270,000 Bitcoins Move Off Exchanges in the Past 30 Days appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)