$ 35,000 BTC – How is that possible and what’s next?

3 min read

At the time of writing, BTC is trading at $ 35,000, sales off across all asset classes continue and stock markets are declining, especially in the high-tech sector.

What does this mean for BTC, which is promoted by many as an “uncorrelated asset” or as a store of value? What good is a store of wealth that goes down with everything else?

Although the answer shows quite a few nuances, I will try to state it here and, based on historical precedent, formulate an orientation scenario for the further development of events.

How a debt-based financial system works

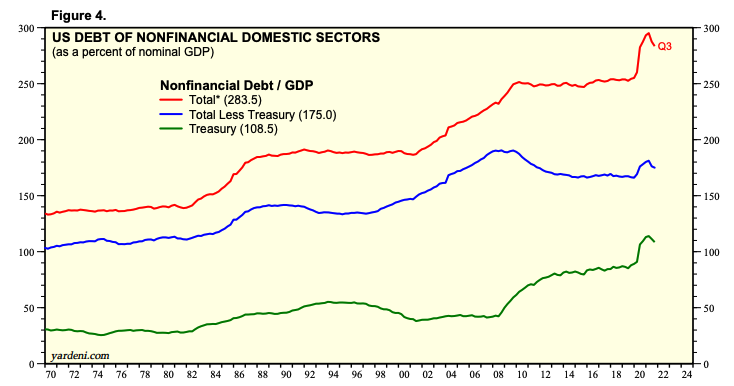

All fiat money is generated through loans. Again, every dollar in circulation has been borrowed, and therefore, by definition, this debt must sometimes be repaid (plus interest). This means that when debt is reduced or not met, this money is “destroyed” – often called a credit contraction. Liquidation and elimination of inefficient investments is a sign of a healthy economic system, but a decline in the money supply can have negative consequences for it, because deflationary pressure leads to a weakening of the counterparty.

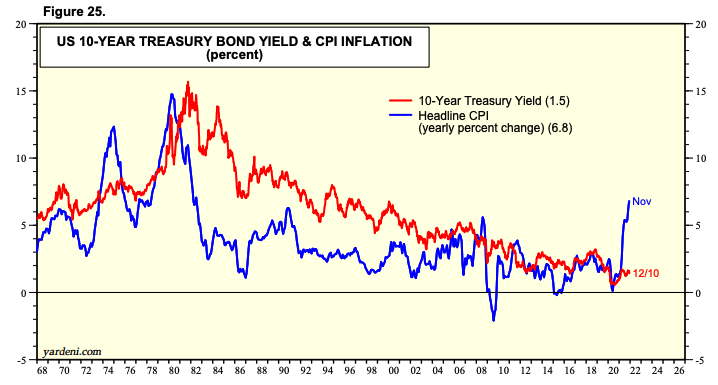

With this in mind, when looking at monetary policy over the last 40 years, it is clear that deflationary events, when loans began to decline, were accompanied by stimulating “easing” in the form of lower interest rates.

This results in a lower real debt burden across the entire economic system, which (so far) keeps deflationary forces in check.

But today we are in a situation where real (inflation-adjusted) yields are deeply negative and typical anti-deflationary forces are no longer appropriate.

Central banks have therefore turned to quantitative easing, the act of buying bonds for printed money. This policy increases asset prices by further reducing revenues. The Fed knows that with a record amount of debt in the global economic system, deflation cannot be allowed. In short, without a steady increase in credit expansion, a deflationary event would ensue and the entire global economic system would collapse on its own.

Most would claim to understand the inflation risks in a fiat monetary system. But few understand the other side of the coin; the deflation and counter-party risks that are present in a fiat monetary system. Credit contraction cannot persist or the entire system collapses…

Looking at the last episode of the big credit market downturn, how did BTC react to that? In March 2020, against the background of the fall of all world markets, BTC for the month fell by 60%.

Many then claimed that the idea of BTC had failed because it could not serve as a “store of value” during the economic crisis. Interestingly, however, BTC then bottomed out before the stock markets, rising 40% by the time stocks just bottomed out.

What to watch out for

If the stock market continues to deteriorate, watch the VIX, the volatility index for the S&P 500.

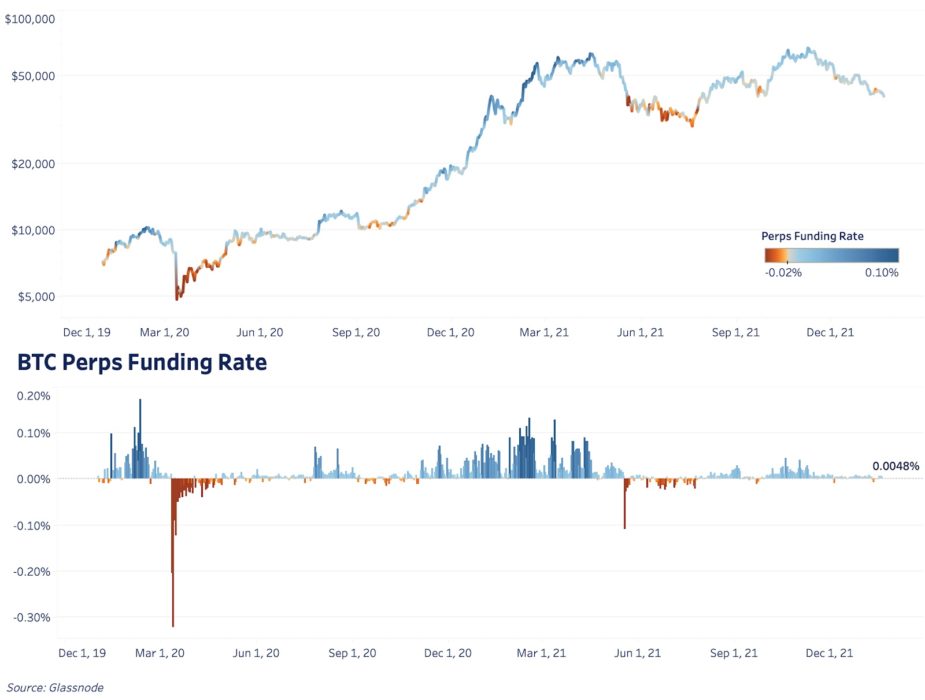

If stocks continue to fall, this will most likely lead to a further weakening of BTC. The real question is what is the limit at which BTC derivatives markets are facing cascading liquidations that have exacerbated the March 2020 sell-off.

The level of perpetual futures financing, which is positive or negative depending on where the contract is traded relative to the spot market, reflects the following dynamics:

Cascading liquidations push the price of futures contracts well below the spot price of BTC, so the funding rate becomes negative after large long liquidations.

Increasingly believe that BTC will bottom before equities, in a far more aggressive fashion. No cohort of investors have as much conviction to mercilessly catch falling knives as bitcoiners. Marginal macro sellers & derivative market liquidations will be met by the HODL army.

The maximum opportunity will open in the event of large-scale liquidation, and most likely it will then seem like an epoch-making shopping opportunity. Leverage is less active in the BTC market these days than in March 2020.

In terms of on-chain data, the cost base of coins for investors is around $ 25,000, and the ability to buy BTC at its “realized price” has always proven to be a significant buying opportunity in the long run.