3rd Largest Hack In Crypto History, Data Shows $280 Million Drained From KuCoin

2 min readThe recent KuCoin hack may have been the third-largest in crypto history as new data indicates that the stolen amount is worth $280 million, instead of $150 million.

Newly aggregated data suggests that the hackers that recently compromised KuCoin’s hot wallets may have taken more than the estimated $150 million, as per the exchange’s report. Considering the updated numbers, the KuCoin hack would be the third-largest in history, with approximately $280 million stolen.

The KuCoin Hack: $280M Taken Instead Of $150M?

An unknown group of hackers exploited the hot wallets of the popular cryptocurrency exchange KuCoin over the weekend. The platform quickly issued an official statement informing that the total amount stolen equaled $150 million worth of various digital assets.

Furthermore, KuCoin guaranteed that the exchange’s insurance fund will fully reimburse users.

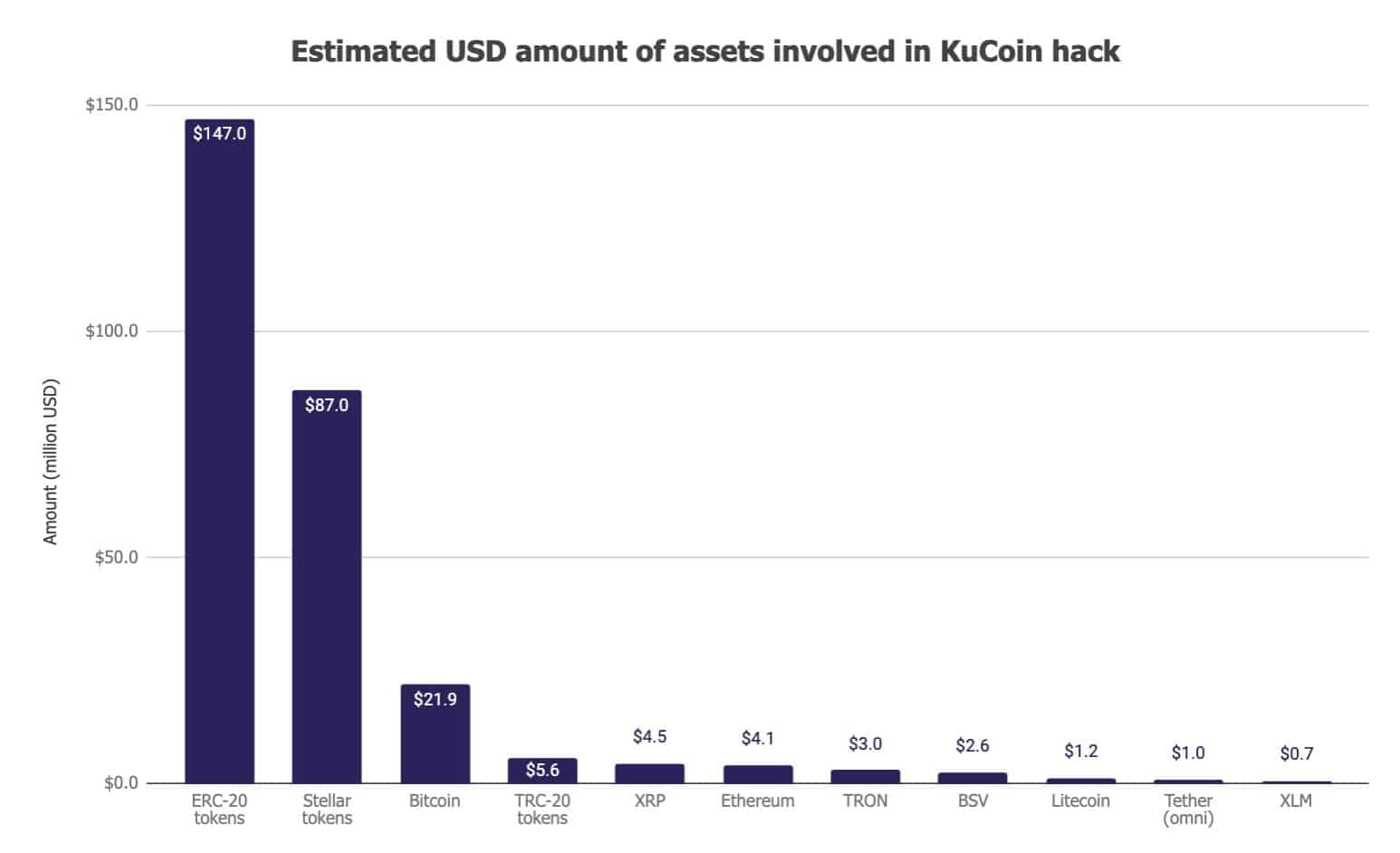

However, the stolen amount could be significantly higher, according to the popular cryptocurrency researcher Larry Cermak. By examining wallets “very likely” associated with KuCoin, he estimated that the amount is actually $280 million, instead of $150 million.

He admitted that some of the tokens have been “frozen, forked, and blacklisted,” but the numbers he came up “don’t reflect that.” Consequently, Cermak questioned KuCoin’s ability to indeed cover the stolen funds from its insurance fund.

Cermak also offered a list of the coins “likely” to be recovered – Velo ($76 million), Tether ($22 million), Orion ($10 million), KardiaChain ($10 million), Ocean Protocol ($9 million), VIDT Datalink ($7 million), NOIA Network ($5 million), and Covesting ($600,000). This equals about 50% of all stolen funds.

Was This The Third-Largest Crypto Hack Ever?

If Cermak’s data is accurate, the KuCoin hack would be the third-largest to date in the cryptocurrency field.

The most significant one came in early January 2018. The victim was the Japanese digital asset exchange Coincheck.

After announcing that the platform has seized all NEM deposits, Coincheck later froze all NEM sales, purchases, and withdrawals. Later on, the exchange confirmed that perpetrators had swiped about $535 million worth of NEM. Interestingly, all stolen funds were grabbed again from the exchange’s hot wallets.

The second-largest hack occurred on maybe the most famous Bitcoin Japanese exchange – MT.GOX. In early 2014, the platform suspended all transactions, closed the site, and declared bankruptcy. A few months down the road, it became clear that MT.GOX was drained for about 850,000 Bitcoins – worth about $460 million at the time, and a lot more as of today’s BTC values.

According to a Tokyo-based security company that presented evidence in 2015, “most or all of the missing bitcoins were stolen straight out of the MT.GOX hot wallet over time.”

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)