Badger DAO Has the Smallest TVL to Market Cap Ratio in the Top 10 DeFi Projects

2 min readAlthough bitcoin (btc) and ethereum (eth) have started to pull back, some major DeFi projects like Badger DAO are heating up and hitting all-time high prices.

This comes as no surprise to traders following the Decentralized Finance (DeFi) market. It has exploded from less than $1 billion in Total Value Locked (TVL) to over $25 billion in about one year.

Almost every top ten DeFi platform ranked by TVL has a higher market cap than TVL in the network. All except for Badger DAO.

Badger DAO Brings Bitcoin to DeFi

Badger DAO was created with a simple premise, to create a decentralized network to enable bitcoin with DeFi applications. With most DeFi applications being built on ethereum, wrapping bitcoin involves a certain level of expertise.

Badger DAO makes it simple to interact with dApps using bitcoin. It allows crypto users to deposit and earn on their bitcoin. Badger DAO has seen massive adoption since its December 2020 release. It has already accumulated over $846 million in TVL.

The Numbers Don’t Add Up

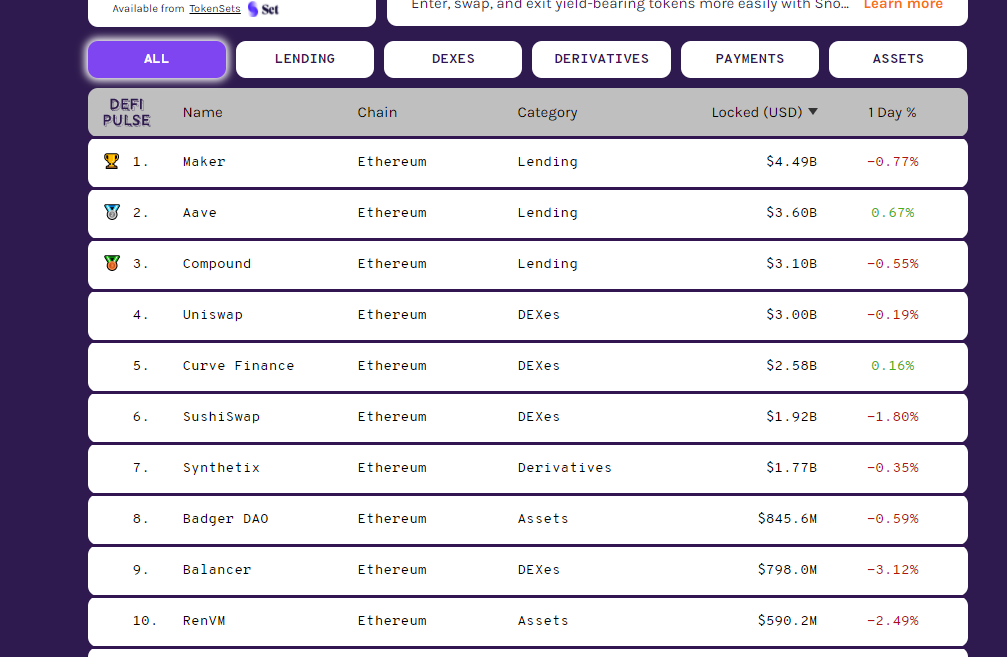

For the sake of this analysis, it’s best to use fully diluted market caps to gather a more comparable estimation between networks. Badger DAO is currently ranked the eighth largest network by TVL.

Let’s look at its nearest competitors using DeFi Pulse data. Examining number seven, you have Synthetix, a popular DeFi platform. Synthetix has $1.75 billion TVL, while SNX has a fully diluted market cap of $3.23 billion.

This represents a market cap/TVL ratio of 1.85. Compared to Badger DAO’s $454 million fully diluted market cap and $846.6 million TVL, you get a ratio of only 0.54. Is this an outlier? Let’s compare some of Badger DAO’s other competitors.

Above Badger DAO at positions nine and ten are Balancer and RenVM. When you calculate their fully diluted market cap to TVL ratio, you get 2.4 for Balancer and 0.89 for RenVM. Although RenVM is inching closer, Badger DAO’s ratio is still significantly behind RenVM’s.

It’s impossible to say exactly why this is the case, although one of the factors could be that the project is relatively new for its TVL, so users haven’t had the same length of time to get involved. Whatever the reason, it appears that Badger DAO may be primed to catch up to its competition.

The post Badger DAO Has the Smallest TVL to Market Cap Ratio in the Top 10 DeFi Projects appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)