Beijing Blasts BTC Miners & That May be the Best Thing for BTC

3 min read- China cracks down hard on its cryptocurrency mining sector, with more provinces feeling pressure from Beijing to take action against the industry

- Longer term the Chinese crackdown will ultimately be a good thing for BTC, with mining activity overconcentrated in China and the shift to renewable energy better for its longevity

It may come as a surprise as to how many BTC investors haven’t ever read the BTC whitepaper or how the blockchain works – they should, it’s not too long and can be found here.

At just 8 pages long (9 if you count the references), any would-be or current BTC investor can gain at least a rudimentary understanding of how the cryptocurrency works.

And having gained that knowledge, perhaps develop a more informed opinion as to the wave of Chinese crackdowns on cryptocurrency miners in the Middle Kingdom.

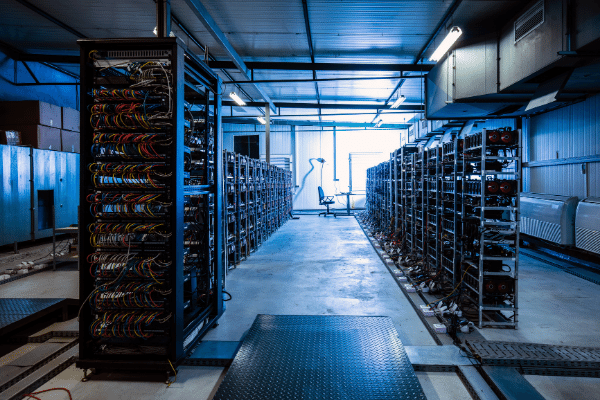

In a nutshell, the BTC blockchain is supported by decentralized nodes or “miners” who secure the BTC blockchain and its transactions by solving complex mathematical puzzles, in exchange for the block reward – in this case BTC.

As more miners get into the game, the puzzle becomes more difficult to reflect the increased competition, but when there are less miners, the puzzle becomes easier – the point of this is to ensure a consistent rate at which BTC is created, roughly once every ten minutes.

The other thing to note is that BTC miners and all cryptocurrency miners in general, are net sellers, putting downward pressure on prices.

While some larger cryptocurrency mining outfits have their own trading divisions with sophisticated strategies to hedge their exposure, the vast majority will be selling BTC to pay for their utility and other current operating expenses.

And that’s why the latest crackdown on China’s largest cryptocurrency mining provinces, whilst disconcerting, will have limited effect on the creation and mining of fresh cryptocurrency.

Since May, when Beijing reiterated its ban on cryptocurrency transactions and warned of the risks of using them for payment, BTC has slipped from its all-time-high of around US$64,000.

But unlike cryptocurrency trading, which is harder to crackdown on, given that exchanges generally don’t have physical offices in China, cryptocurrency miners are a more obvious and visible target.

Sichuan, a southwestern province in China which is rich in hydroelectric power, has ordered the 26 largest local cryptocurrency mines to stop operating pending investigations, according to Chinese media.

The probe by Sichuan’s local Development and Reform Commission’s Energy bureau, and which will last till June 25, has been seen as a shot across the bow for Chinese cryptocurrency miners to pack up and head out of China.

Sichuan’s abundance of clean and renewable energy thanks to its many waterfalls and extensive dam network, provided a brief sanctuary for cryptocurrency miners leaving provinces that relied on more pollutive coal-fired power stations.

And unlike a traditional mine which is tied to geography, the processing units that cryptocurrency miners rely on can be made mobile if needed, using anything from shipping containers to mobile rigs.

But that might ultimately prove to be a good thing for BTC.

With some estimates putting China’s share of global BTC mining as high as 75%, the risk of potential 51% attacks on the BTC blockchain because of that high level of concentration was ever present.

Because the BTC blockchain relies on a consensus mechanism, a malicious actor who was able to control over 51% of the BTC mining capability could jeopardize the network by confirming fraudulent transactions or double spending.

While that would undermine the value of BTC, and so would be unlikely to be perpetrated by a miner looking for economic benefit, it would be in the interest of a government looking to destroy BTC to do so.

Now that China’s BTC miners are headed offshore, the BTC blockchain has a better shot at decentralization and its longevity.

And with Chinese BTC miners reducing their reliance on pollutive coal-fired power, there’s even the prospect that most BTC would be mined using renewable or clean sources of energy, bringing closer the day when Tesla (+1.09%) will accept BTC again for its electric vehicles.

Last week, Telsa CEO Elon Musk tweeted that the electric vehicle maker would consider accepting BTC again when over 50% of its mining activity was from renewable sources.

The post Beijing Blasts BTC Miners & That May be the Best Thing for BTC appeared first on SuperCryptoNews.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)