Bitcoin History Suggests Multiple All-Time High Breaks on the Horizon

3 min readIn a world where all-time highs attack in all kinds of ways, only one cryptocurrency can keep going up it seems: Bitcoin (BTC). This is the story of a cryptocurrency that just keeps getting more expensive.

A Bullish History for BTC

Well, it appears to be Bitcoin season again. Those who held out from the top near $20,000 in 2017 are finally being rewarded with higher prices.

While a few bitcoin hodlers have taken profit, others claim that the fundamentals and the short-term capital gains taxes keep them hodling.

And while a few others feel that the crypto beast has run out of steam, bullish predictors keep piling up. The momentum could just be good news.

Almost all bitcoin traders made a profit in December after BTC finally touched $20,000. Yet that didn’t stop it from smashing through to $23,000 and then $24,000 on Dec 19, 2020.

Interestingly, this multiple all-time high (ATH) phenomenon has been a pattern for BTC. Algorithmic trader Jan Uytenhout pointed out on Twitter how often BTC breaks multiple ATHs once it breaches the first.

He explained how in 2013, BTC hit all-time highs 59 different ways before a pullback. In 2017, it did it in 70 different ways.

But the bullish nature of just smashing through records is not the only thing to suggest BTC has a ways to go. Uytenhout explained how the week following an all-time-high had been positive 97 out of 129 times since 2013. (This is 72% vs. 56% for any random week).

And for those who are willing to hold, things get better. The two-month return after an all-time high was positive 80% of the time. If history repeats itself, BTC statistically has (a lot) more room for growth.

On-Chain Data

While bitcoin has found temporary support around $23,000, on-chain data also suggests a bullish future.

According to a Glassnode Insights blog post, “Reserve Risk” is low, despite the massive price increase. A Reserve Risk is considered low when the price is relatively low, and confidence is relatively high.

Since the fundamentals of Bitcoin appear to outweigh the price in this instance, it is considered bullish.

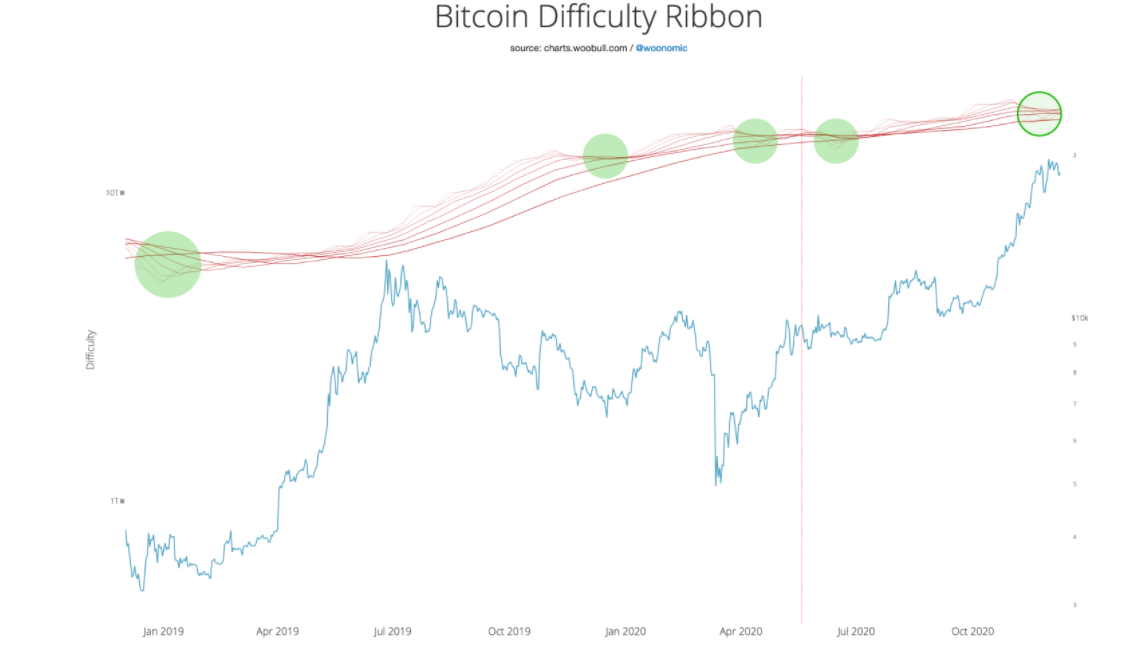

The firm also looked at Bitcoin’s Difficulty Ribbon. This is a metric used by statistician Willy Woo that Glassnode says is a reliable medium-term indicator.

The metric uses moving hash rate averages to predict price. After some contradictions, the ribbon is now showing a bullish pattern for the next three months.

Even though bitcoin’s price is just so damn high, historically, it seems that all-time highs have just become all-time highers! The market has been strong and fundamental news continues to flow in.

It may seem like bitcoin has some legs to stand on. But if there’s one thing that’s for certain, expect some volatile times ahead.

The post Bitcoin History Suggests Multiple All-Time High Breaks on the Horizon appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)