Bitcoin’s Inferred Value Surpasses That of the Russian Ruble

3 min readAccording to data compiled by podcast Crypto Voices, bitcoin’s inferred value is now higher than the entire currency of the Russian ruble.

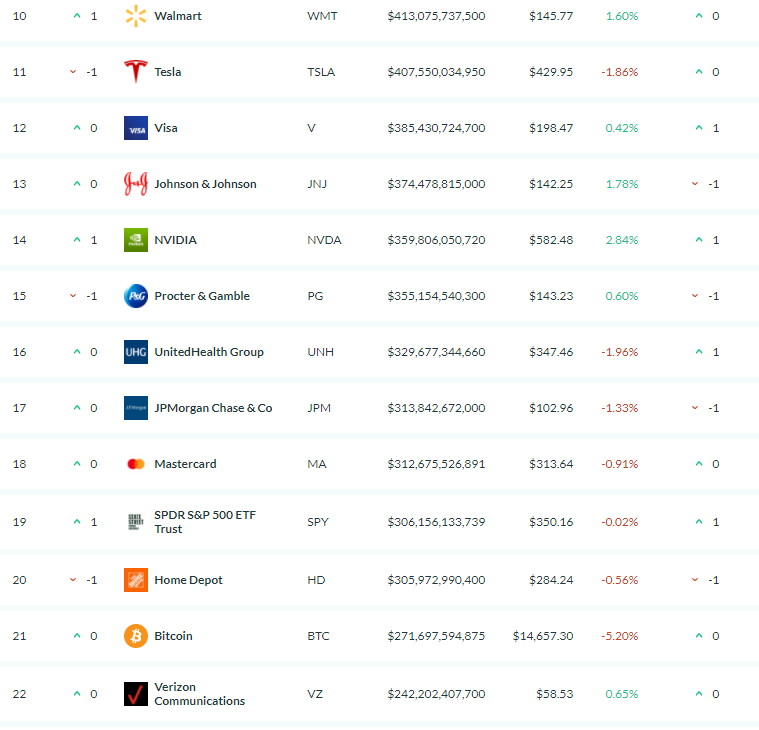

Assetdash.com also says that Bitcoin is the No. 21 largest asset by market cap in the world.

CMC, but with a twist. The market cap rankings of all companies and crypto on one page. #bitcoin is now worth more than #PayPal

https://t.co/g157OKT5Be pic.twitter.com/Mi03Nue7D1

— Coin Bureau (guy.eth)

(@coinbureau) November 7, 2020

Can You Hear Me Now?

Squished between Verizon and Home Depot, Bitcoin is now one of the largest assets in the world, according to assetdash.com. The top players on this list include giant companies like Apple, Amazon and Alibaba.

This puts bitcoin just two spots below the S&P SPDR ETF Trust, the largest ETF in the world. This ETF tracks the performance of S&P 500 index and represents $306 billion in stocks.

When compared to currencies, bitcoin does just as well. Including gold and silver, only 10 currencies are worth more than bitcoin in terms of market cap.

According to Coingecko, the total market cap for all cryptocurrencies is about $428 billion. This valuation would put crypto in the rankings above Walmart and Tesla.

Market cap is not the only way to measure value. After all, hype and bubbles can drive up both demand and prices. The P/E ratio of Tesla is almost 863. In other words, Tesla’s price, on average, has been 863 times the year’s earnings. Whether the future’s potential earnings will close this gap remains to be seen, but simply having a higher price does not equate to true higher value — only a higher market value

To some extent, comparing bitcoin to public corporations is comparing apples to oranges. Bitcoin is a store of value or currency, and (basically) the only factors driving value are supply and demand. There are no shareholder or board meetings: only more buying and selling.

Converting Currency

If assets like stocks are not such a great analogy, perhaps bitcoin could more easily be compared to currencies. Crypto Voices’ graph puts bitcoin a spot above the Russian ruble in terms of the monetary base. The monetary base is the amount of all liquid assets in a currency, in theory at least.

The US had an estimated monetary base of $3.9 trillion in 2016. Japan has a much higher monetary base than most other countries. If bitcoin’s market cap was equated with its base, it would rank high — really high. Crypto Voices said the world above $14 K per bitcoin was a world in which the digital currency was a major player.

Monetary Base *update.* #Bitcoin vs. all other money in the world. Above $14k… #bitcoin has passed the Russian ruble, for the first time ever. Puts it in *top 9* among all fiat currencies, ranked at #11 if you include gold and silver above ground. pic.twitter.com/eS13ezP62Y

— Crypto Voices (@crypto_voices) November 6, 2020

Other sources are a little less encouraging. Fiatmarketcap.com claims that the Russian ruble is worth about 50 million BTC, or about $723 billion. Though it seems discouraging that bitcoin will only ever have a 21 billion circulation, it is important to remember that the amount of rubles in circulation is unlimited.

All is not as it seems, however. Estimates of fungible assets vary, especially taking into account broader perspectives like futures markets and leverage. The Bank of International settlements claims that only $5 trillion exists, but the estimates could also be as high as $18 trillion.

Either way, bitcoin is still up about 36% since 30 days ago. Recently, bitcoin has been breaking its own 2020 highs and has decent Wall Street support. With more Wall Street companies adding bitcoin to their treasuries, bitcoin is shouldering its way to a place near top companies and currencies alike.

The post Bitcoin’s Inferred Value Surpasses That of the Russian Ruble appeared first on BeInCrypto.

(@coinbureau)

(@coinbureau)

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)