Coinbase Launches USD Coin 2.0 to Delegate Gas Fees

2 min readAs Ethereum network fees continue to climb, crypto companies are looking for alternatives to bring the cost of transfers back to acceptable levels. Coinbase is the latest with an upgrade to its stablecoin USD Coin.

Centre Consortium members Circle and Coinbase have just launched an upgraded version of their popular USDC dollar-pegged stablecoin. Going live on August 27, USDC 2.0 aims to tackle high gas fees by allowing developers to delegate it to other wallets or take fees in USDC instead.

Removing ETH From The Picture

The official announcement explained that most users need to keep a balance of Ether in their wallets to make transactions. It added that this resulted in unnecessary complexity:

“This complexity presents a barrier to mainstream adoption and broad usage of digital dollar stablecoins for internet payments.”

To address the problem, USDC 2.0 will introduce what it terms as “gasless sends,” which enables wallet developers to ‘abstract away’ the complexity of gas fees. It would allow them to delegate the payment of gas fees to another address instead, which negates the need for the user to hold a balance of ETH.

Developers could either pay the fees on behalf of their clients or allow a third-party service to take the burden. The aim is clear – remove Ethereum from the equation and enable users to send and receive USDC payments solely using USDC, and with fees expressed and paid in USDC.

There are additional security enhancements with the new coin, which include a new set of on-chain multiple-signature contracts with new consensus mechanisms. It added that the upgrades are entirely backward compatible, with no impact or changes to existing wallets, exchanges, or apps currently integrating with USDC.You Might Also Like:

According to Coinbase, USDC has a market capitalization of $1.4 billion and handles more than $90 billion in on-chain transaction volume.

Ethereum Fees Retreating … Slowly

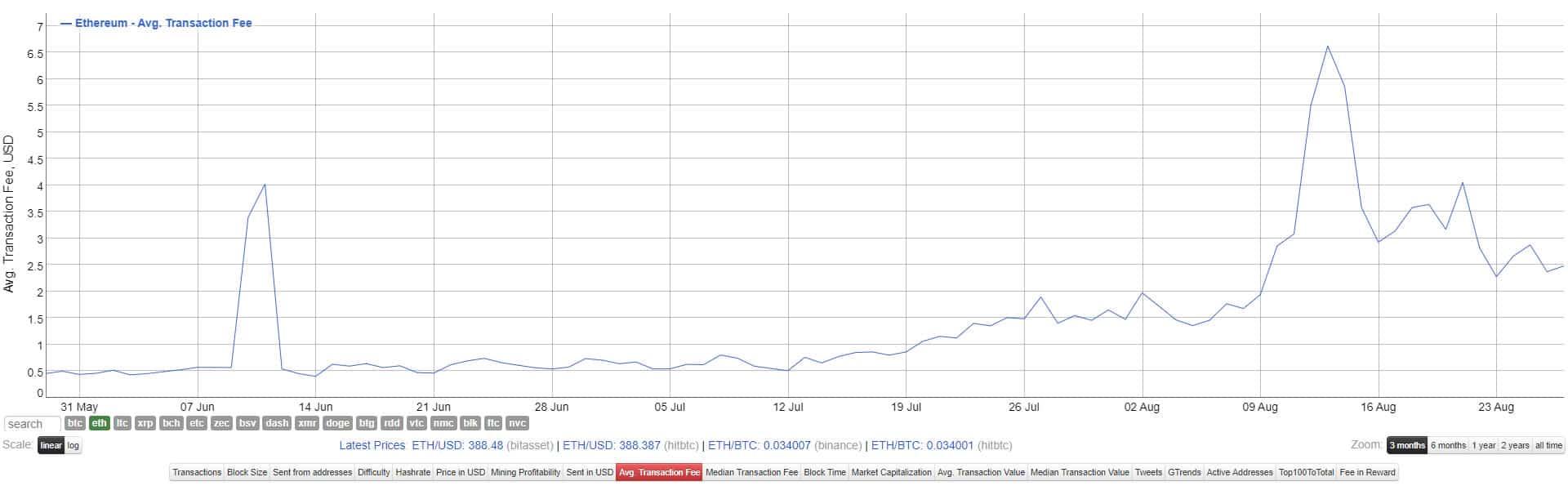

Ethereum network fees are still at their highest levels for over two years, but they have fallen a little over the past two weeks. From an all-time high of $6.60, the average gas fee has fallen back to $2.50, according to Bitinfocharts.

However, this is still way higher than what it has been for most of the first quarter, which was closer to $0.15. Driven by the DeFi boom, the number of transactions on Ethereum is also just off its all-time high at 1.13 million.

ETH Gas Station reports that the biggest producer of network fees is Uniswap with $12.7 million over the past 30 days, and Tether is second with 10.5 million dollars in fees generated.

You might also like: The Bitcoin Network Now Consumes 7 Nuclear Plants Worth of Power

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)