DeFi Tokens Still Dominate Despite Market Correction

2 min readDecentralized finance tokens have experienced a large pullback during the recent market correction but are still dominating in terms of gains made so far this year.

Cryptocurrency markets have made minor gains over the weekend with nearly $5 billion added to total market capitalization. The figure has returned to the $346 billion level — down 13.5% from its 2020 high, but still up over 80% since the beginning of the year.

Big Gains for DeFi Tokens in 2020

According to Messari Crypto’s DeFi Returns tracker, the collective 45 DeFi tokens tracked are up 745% since the beginning of the year and 240% over the past 90 days. The shorter-term picture highlights the pullback with that list of tokens having contracted 8.5% over the past 30 days collectively.

— Jack Purdy (@jpurd17) October 4, 2020

The tracker estimates that DeFi token market capitalization is around $5.3 billion, which is just 1.5% of the total for all crypto assets.

The top-performing DeFi token of 2020 has been Aave’s LEND, which has made a whopping 2,925% since the start of 2020. The LEND token is currently being migrated to AAVE tokens, which involves a supply cut of 100x.

The second-best performer of 2020 has been Yearn Finance’s YFI which has made 1,670% according to the tracker. YFI has taken a 30% hit over the past seven days, however, dropping its price back below $20,000.

Not all DeFi tokens have enjoyed such a prosperous year though and one of these crypto ‘lemons’ has been SUSHI which has dumped over 90% from its all-time high. The native token from flash loan protocol bZx Network has also slumped following a number of hacks and security exploits.

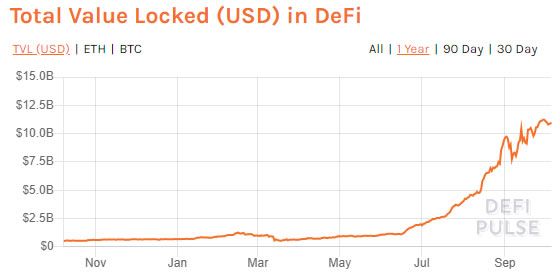

Total Value Locked Close to All-Time High

According to data from DeFi Pulse, the total value locked across all DeFi platforms is close to its all-time high, hovering around $11 billion.

Since the beginning of the year, TVL across DeFi platforms has gained 1,500% reaching new milestones virtually every week on the back of countless clones and new yield farming incentives.

The top-performing protocol at the time of press is Uniswap which has a TVL of $2.3 billion and a market share of 21%. Notably, there are now five DeFi platforms with more than a billion dollars on the list.

The post DeFi Tokens Still Dominate Despite Market Correction appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)