FED: Bitcoin is Not New Money

5 min readResearchers at the Federal Reserve Banks have stated bitcoin is actually not new money at all.

“Bitcoin, and more generally, cryptocurrencies, are often described as a new type of money,” they say. “This is a misconception. Bitcoin may be money, but it is not a new type of money.”

New money

They argue bitcoin is just fiat money, like the dollar, nothing new about it. However, they do say there is something “radically new.”

“The real innovation of cryptocurrencies is that they offer a radically new exchange mechanism,” they say.

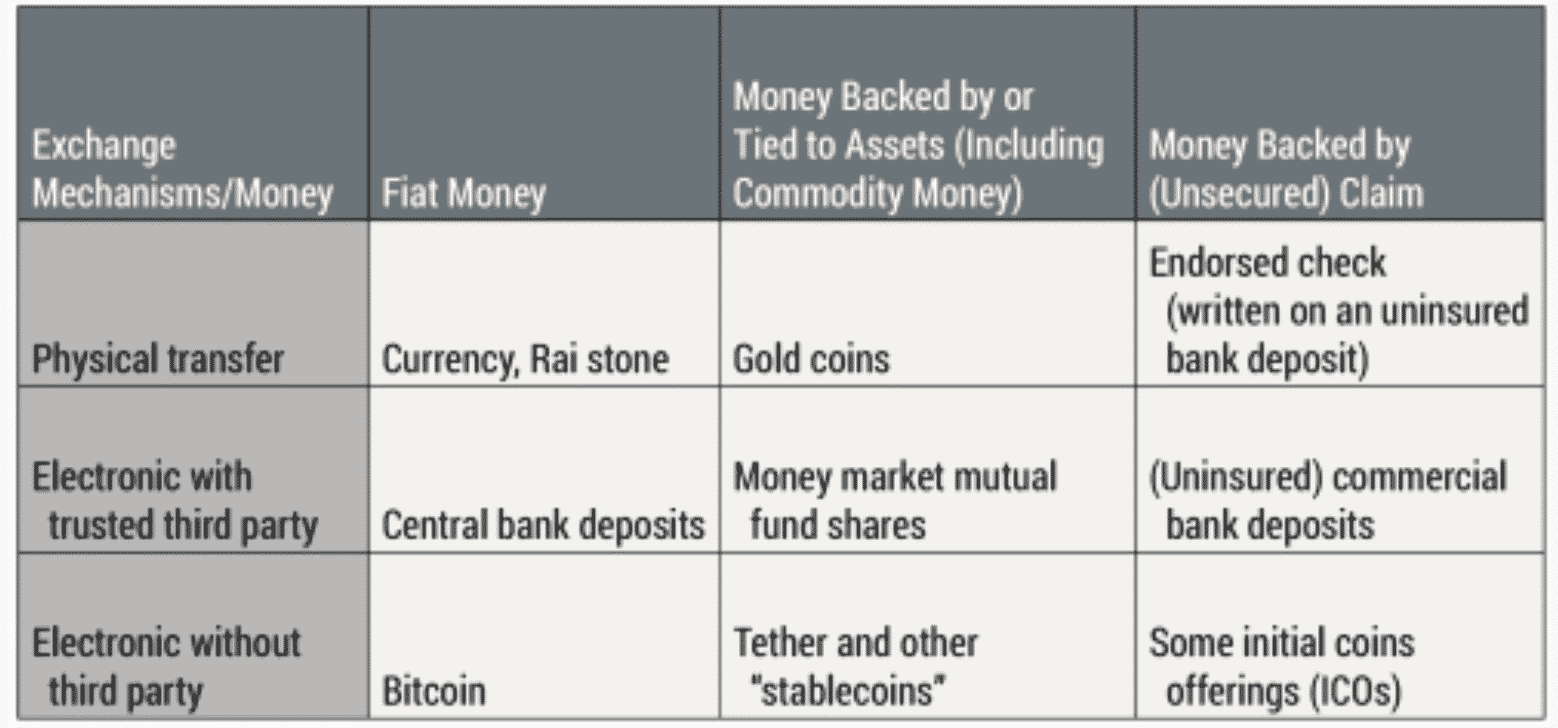

“The third row of the table (“electronic without third party”) did not exist before 2009,” they say, further adding:

“This type of exchange mechanism can support the transfer of different kinds of monies; fiat money in the case of bitcoin, money backed by assets in the case of stablecoins, and even future services or products, as in the case of ICO tokens.

And this type of transfer mechanism could also support the transfer of other types of assets, like CryptoKitties.”

And of course we get to the real point they’re trying to make, which is that the trusted third party can still remain as they can do bitcoin, but with hookers and blackjack:

“History provides lessons about what makes a good money as well as what makes a good transfer mechanism.

These lessons could help cryptocurrencies evolve in a way that makes them more useful. But to know which lessons are relevant, it is important to be clear about what is new about Bitcoin.”

What Fed is saying is nothing new, it’s just too simplistic we’ll say to be a bit charitable to the researchers.

The payment mechanism of bitcoin is new and a very important part, but its very nature comes with something else which makes bitcoin like fiat, but not quite fiat.

Its nature allows one to ask, and maybe this is precisely what Nakamoto did ask: can one replicate gold with just a few lines of code?

We don’t know who Nakamoto is, but one can imagine when they hear for example that something is Turing Complete, and when they learn that means they can code anything on it, some smart person may well ask: anything?

One can argue the researchers have simplified so much, they’ve made the different categorizations irrelevant because even if we say bitcoin is digital gold, they can say that’s nothing new as commodity money has existed.

If we say: but you can’t change the supply, unlike gold’s supply which you can find aplenty in comets, then they may well argue that’s too small a distinction.

Bitcoin is not a commodity, however, they can rightly say. A commodity is something that comes from the ground, it’s physical.

Yet we would argue bitcoin is not fiat either. Fiat is as one wills, and here there is no one, there is the code and a whole network that enforces the rules of the code.

You can change it, but not by fiat, not at will and if we are going to be very technical, you can’t actually change it.

You can clone it, in a chain-split as it is called, but that’s creating a new network, it’s not changing the current one.

The bitcoins therefore do not come from thin air, as Trump says, and they are not at will fiat, as Fed says.

Bitcoin comes from those mining machines which translates to from energy which makes it a commodity, but an artificial commodity as we can change it or can set its rules provided all agree to the rules with them then judged by the market.

So if it is not fiat because it is set in code, and if it is not quite a commodity, and if it is not a derivative, then what exactly is it?

Well a new form of money obviously. In its base form, its unduplicable code. You can’t copy it.

You can obviously copy paste the code and launch it on a new github repository, you can create your own network and you can even chain-split it, but within its own network, you can’t copy a bitcoin.

Reducing all of this to just a payment method can be a choice and obviously one can design it and modify it to be just a payment network.

But that would lose something very new, the digital asset part. Now someone like Jamie Dimon can well say the dollar is digital, but you’re not transferring actual dollars when you move them online. Bitcoin on the other hand is an actual thing.

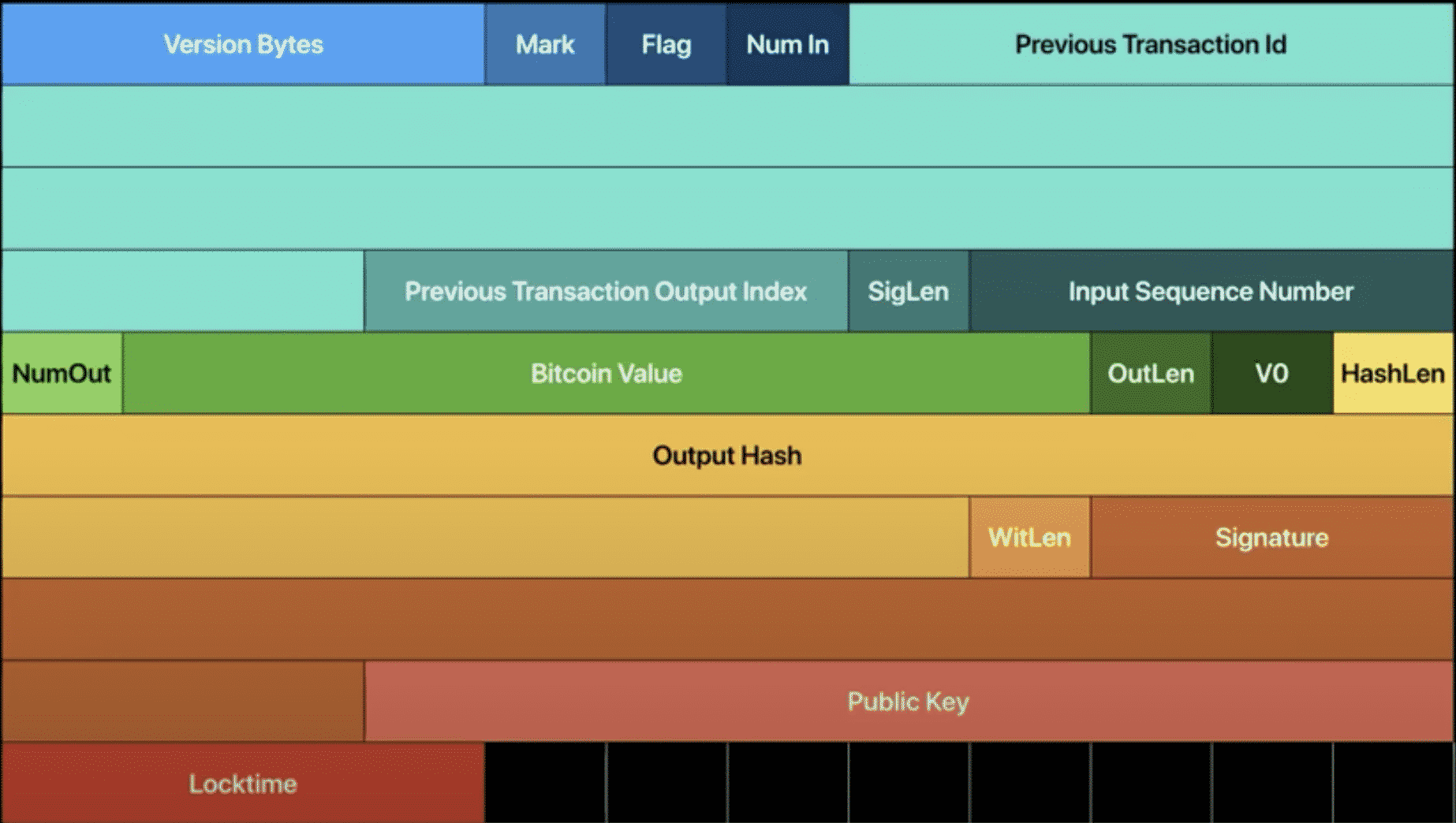

So that’s what a bitcoin looks like. There is also a very nice visualization of a bitcoin transaction, but it’s basically a real thing. It’s data, and no one can copy this data in a meaningful way. And this data is yours if obviously you’re the owner.

So to say this is fiat is not very correct, but it can be designed like fiat, or gold, or stocks.

For bitcoin Nakamoto himself said the design is like gold. So making it a commodity in a digital form created by fiat.

Thus ultimately making it neither fiat nor a commodity, but a bit of both. Meaning it is new if we are going to use categories properly and not reduce them to absurdities.

The question is of course what should the category be called and after we tried many different names through the years, crypto is the clearest one with the least opportunity for miscommunication or for requiring clarification.

In the specific design of bitcoin, where no one person or group can change it or its nature, it should be called crypto-money.

That is something new. Obviously not something uncomparable to other things, but it is new because you can devalue gold by changing the weight of the coin and you can devalue fiat at will. Bitcoin can also be devalued in the abstract, but only if all agree to devalue it, which is quite a different thing.

And moreover, if just one person disagrees, they can continue operating on the current bitcoin, and as it is digital with it ultimately memorizable, no one can do anything about it as much as they can do anything about the many tales of folklore passed to today through collective memory.

You may also like: Big Brother Is Already Watching Your Coins

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)