According to the analysis, there are only a few Bitcoin sellers preventing rally

2 min readIt seems that Bitcoin has entered no man’s land, the price bouncing between 11,000 and 12,000 US dollars. According to the new analysis, it is likely that this consolidation will be resolved upwards. This analysis suggests that there is little resistance that prevents BTC from starting rally to new highs and higher.

Bitcoin rally before the start

According to the latest data from WhaleMap shared by the crypto trader Byzantine General, there is little resistance that could stop the start of the bitcoin rally from current levels. The trader wrote with reference to the chart below:

“To add to this…: This chart shows where bitcoins where accumulated at. What do you see? There are very few bag holders left. Meaning, there is little sell pressure left. The only real sell pressure now is people taking profits.”

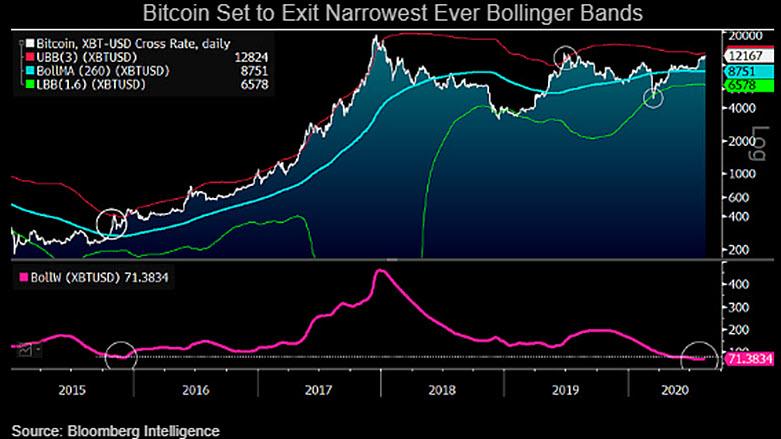

Mike McGlone, chief analyst at Bloomberg Intelligence, also commented on how the dynamics of supply and demand for Bitcoins suggest that prices could rise in the long run.

Commodity analyst and cryptocurrency bull said on August 19:

“Bloomberg Intelligence Commodity Primer – Something unexpected needs to happen for #Bitcoin’s price to stop doing what it’s been doing for most of the past decade: appreciating. Demand and adoption metrics remain favorable vs. the #crypto asset’s unique attribute of fixed supply.”

Fundamental trends suggest that the bulls have control

Some fundamental trends also suggest that bitcoin bulls are taking control. Fidelity Investments filed an application with the US Securities and Exchange Commission (SEC) this week for a fund focused on Bitcoins. Under the name “Wise Origin Bitcoin Index fund I, LP”, the fund will soon be offered to accredited investors. Bloomberg said the fund will only hold Bitcoins and will act as a way for accredited investors to gain a position in a key digital asset:

“The passively-managed, Bitcoin-only fund will be made available to qualified purchasers through family offices, registered investment advisers and other institutions, according to a person familiar with the matter. Fidelity Digital Assets will custody the fund, the person said. The minimum investment is $100,000.”

In addition, Federal Reserve Chairman Jerome Powell announced this week that the central bank could target inflation above 2%. Analysts say the comment will increase the intrinsic value of rare assets such as BTC and gold.

Are you ready for the upcoming bitcoin rally?

You might also like: The Bitcoin Network Now Consumes 7 Nuclear Plants Worth of Power

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)