Grayscale Reportedly Stockpiles Another 1.3K BTC & 100K ETH in 24 Hrs

3 min readData retweeted by Grayscale CEO Gary Silbert suggests that the firm purchased 1,276 more bitcoin over the last day. Elsewhere, there were claims that Grayscale bought another 100,000 Ether.

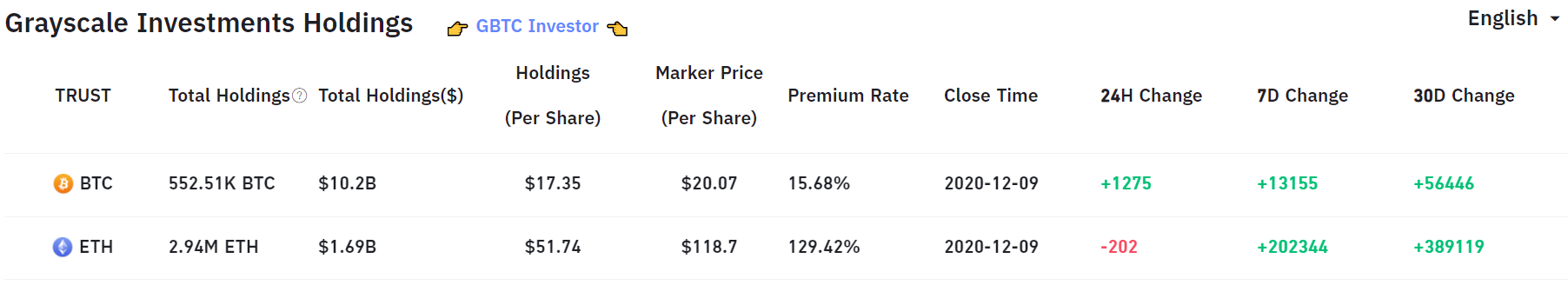

A self-proclaimed blockchain enthusiast named Mark Rex tweeted a screenshot of a spreadsheet. The data suggests that Grayscale purchased another 1,276 BTC on Dec 9, 2020, and 13,232 BTC over the past week.

The acquisition amounts to a cool $241 million. And the data appears on a spreadsheet that calculates the share price and NAV (net asset value) of Grayscale’s different crypto trusts.

The screenshot appears authentic, but a cursory search for the original revealed nothing. Mark Rex also commented on his post that users should download the foldapp wallet using his referral code, “while you’re here.” This brings into question the true purpose of the tweet.

To the Source

The origin of the information is not exactly clear, but Mark Rex did leave a trail of crumbs in the comments. On June 18, 2020, a crypto enthusiast who goes by the handle “fillippone” posted a long post on Bitcointalk, describing the ins and outs of the Grayscale Investment Trusts.

It seems the intricate mechanism described in this extensive post was used to calculate data, including purchases, about Grayscale.

The Bitcointalk spreadsheet includes much reporting on Grayscale’s assets, including the publicly-released quarterly reports.

Most of the information about Grayscale is usually gleaned from SEC documents or announced by the company on Twitter. The spreadsheet’s calculations add a new degree of understanding.

Though Grayscale has not confirmed the purchases, CEO Barry Silbert did repost Mark Rex’s Tweet. It also makes sense that Grayscale would purchase more BTC, considering the market correction over the last few days.

Ether/Or

Meanwhile, a YouTuber and crypto educator, GirlGoneCrypto tweeted that Grayscale purchased 100,000 new Ether tokens in 24 hours.

The source of this information was not revealed, and neither Grayscale nor Barry Silbert confirmed or commented on the post.

Data from bybt.com seems to support the ~13,000 increase in BTC under trust holdings. But the amount of ETH tokens in the trust remains unclear. Bybt estimates last week’s added tokens at around 200,000.

Overall, Grayscale Investments has been vocal about its love of Bitcoin, especially in the last few months.

In an interview last week, Grayscale Managing Director Michael Shonnensein said that there was growing interest in Ethereum from institutional investors. In August, it launched a television advertisement to raise awareness about cryptocurrencies.

Meanwhile, steam may be slowing down on Wall Street for Bitcoin. Microstrategy made headlines when it announced it would purchase bitcoin as a reserve asset, though its stock recently dropped as stockholders were getting $0.23 per $1 exposure to bitcoin.

On Dec 8, 2020, Citibank analysts downgraded Microstrategy’s stock from “neutral” to “sell” on fears bitcoin’s rise may be slowing.

However, Grayscale is still loading up on crypto assets. Nonetheless, Bybt.com data suggests that Grayscale’s Bitcoin Trust is trading at a 16% premium, while Ether trades at a 129% premium.

Wall Street’s infiltration into crypto continues, though, with data based on anonymous google spreadsheets and retweets, the road is still rocky.

The post Grayscale Reportedly Stockpiles Another 1.3K BTC & 100K ETH in 24 Hrs appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)