Legacy Finance Is Running Out of Time

6 min readEverything about the world’s financial system needs an upgrade. Legacy finance, this fact became even more true amidst one of the deadliest health crises in over a century. Unfortunately, if regulators and entrepreneurs aren’t careful, they will do irreparable damage to institutions like the U.S. dollar. And at a time like this, even the slightest mistake could see America’s hegemony dissolve in an instant.

Legacy Finance Balances Speed with Innovation

Despite the pace of technology, the public sector’s resistance to change is striking. This trend is even more evident when one examines financial infrastructure.

From decrepit code like COBOL to distributing paper checks amidst a deadly health crisis, everything about how we think of moving money needs upheaval. The Federal Reserve isn’t nearly as nimble as your favorite Silicon Valley startup, however. And for good reason.

For all the founders writing Medium articles and stoic tweets about life or death for their seedling businesses, the health of the U.S. dollar is critical to global stability.

In an interview with Crypto Briefing, a co-founder of the Digital Dollar Foundation and former chief innovation officer at the CFTC, Daniel Gorfine highlighted this point.

Along with former CFTC commissioner, Christopher Giancarlo, the Digital Dollar Foundation and Accenture are working on tokenizing, not merely digitizing, the greenback. Gorfine said, “We’re still very early, but there’s no rush. We can’t get this wrong. It’s the U.S. dollar after all.”

Instead of moving fast and breaking things, initiatives in crypto, as of late, are valorizing quality over speed. Irreversible code that channels millions of dollars, let alone the roughly $1.9 million Federal Reserve notes in circulation, needs to be full proof.

Failing to do so has already led to several hacks, bugs, and exploits in the crypto space.

Despite its novelty, the move to tokenize the world’s reserve currency has slowly been gaining momentum in Washington. Both Giancarlo and Gorfine first wrote about the idea in a Wall Street Journal op-ed in October 2019.

Gorfine said that he encountered blockchain technology and cryptocurrencies throughout his tenure at the CFTC.

“There is better technology that should impact financial services,” he said. “Take the way we move assets, for instance. It’s like how we adopted email and made sending letters nearly obsolete. Tokenization can do something very similar.”

The project finally launched in January this year and has been earning fans ever since. “We’re not really running into opposition,” said Gorfine. “The topic is worthy of exploration, even for skeptics.”

Accenture, a global business and technology consultancy, was on board immediately to help with this digital upgrade. Both Accenture and the Digital Dollar Foundation make up the Digital Dollar Project.

“We have extensive experience with other central banks working on [Central Bank Digital Currencies] CBDC’s,” said managing director of the firm’s banking and capital markets strategy, Danielle Martell.

Looking across the current landscape, Accenture has had a hand in developing digital currencies for Singapore, Sweden, Canada, and Europe’s ECB. Their roster of experts and heaps of experience makes them an ideal partner for the venture.

Though these countries already have a head start, along with China’s swift progress on its CBDC iteration, the duo explained that this is less about competition and more about “future-proofing” the dollar.

“This is not a defensive measure, but an offensive opportunity,” said Gorfine. “We want to upgrade the infrastructure of a public good, drive efficiency gains, reduce costs, and improve financial inclusion.”

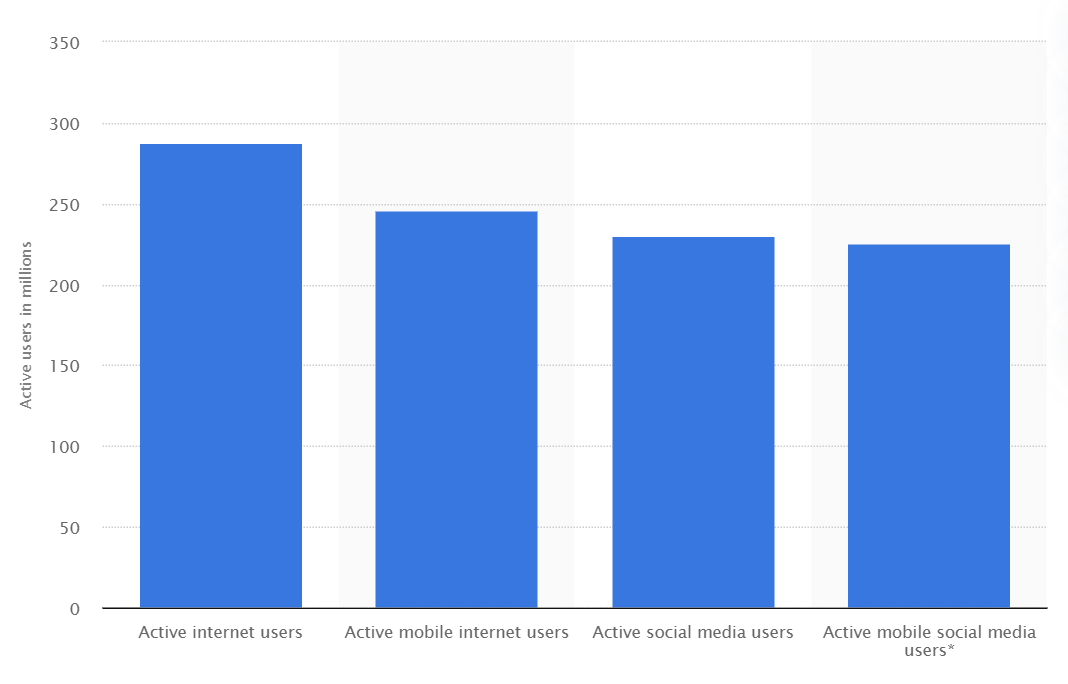

This inclusion also hinges on a broadband connection. It might not seem like an issue, especially in a country like the United States, but this was a significant concern in the latest discussion in the House Committee on Financial Services last Thursday.

Despite the importance of moving slowly, but correctly, it is unlikely that a digital dollar will serve Americans currently suffering from the coronavirus pandemic.

Paper Checks in a Digital Economy

The rapid spread of the coronavirus has revealed many systemic problems with our world.

From supply chains to the social woes of lockdowns, the effects have been felt across every sector. These effects have been the most dramatic in the high unemployment rates in the United States.

As such, President Trump doled out $1,200 to every citizen. For many, these checks didn’t arrive until May. The crypto community scoffed at the gesture; during a lockdown, why is the government sending paper checks only redeemable in person?

Distributing money more effectively has been the bread and butter of the broader fintech industry.

Long before the health crisis, neobanks and blockchain entrepreneurs have been working hard to reimagine value. This included the likes of Revolut, Monzo, Crypto.com, Uphold, and many others.

Michelle O’Connor, the VP of Marketing at Uphold, told Crypto Briefing in an interview:

“We actually digitized the US dollar back in 2014,” she said. “Crypto can solve a lot of issues, but we still need a bridge to legacy finance. At the same time, we can beat legacy finance and banks on the high fees.”

Uphold is a unique, long-standing crypto company. It’s a digital wallet that allows users to hold commodities, crypto, and various fiat currencies. “We’re really solving for the expat,” said O’Connor. The platform also offers a unique vision into a fully-interoperable world.

With the Uphold debit card, users could buy gold on the platform, sell it for Digibyte tokens, and then use those tokens to purchase dinner at their favorite restaurant.

Thanks to digitization, we have returned to a barter system. It would appear that users are taking notice too.

The company reported 375% more new customers in Q1 2020 than in the same period last year. Between April and May of this year, the number of exchange transactions more than doubled. O’Connor also added that there were many $1,200 purchases right around the time that checks were distributed.

“We’ve seen an enormous uptick in the number of signups to the platform as well as from people buying Bitcoin,” she said.

Long Bitcoin, Long Innovation

Upending a system that has been in place for over a century is going to take time.

The initiative will also include far more than just the U.S. dollar or Bitcoin. At the same time, the latest crisis offered a unique glimpse into the fragility of how the world currently operates.

It also offered an opportunity for bold ideas. And the Digital Dollar Foundation wants as many people as possible to participate in this opportunity. This is, in part, why the latest white paper fails to dive deep into too many technical details.

“The technical component is missing because we want to keep the discussion as open as possible,” said Martell. “Still, privacy-compliance is really important to work through. We need a new, flexible technology to meet our fast-changing world.”

Bitcoin and a national cryptocurrency aren’t antithetical either. Edgar Fernandez, a co-founder of EOS Costa Rica, told Crypto Briefing, “there will always be a need for decentralized, censorship resistance value exchange. I don’t think CBDCs will allow that, and consequently, they will not compete with BTC.”

As Martell mentioned, privacy concerns will be a critical component for a CBDC. Although most cryptocurrencies are highly-traceable, there is an effective range of mixing and obfuscation services that can help hide user identities. This likely won’t be the case with a national cryptocurrency.

Alex Wearn, the CEO of the decentralized exchange IDEX, said:

“CBDCs will almost certainly be restricted to transfers between known parties, which makes them more of a competitor to products like Libra than Bitcoin or Tether. But perhaps their introduction is what prompts regulators to become more strict on existing stablecoins which currently only monitor entry and exit points.”

Ultimately, the world we live in today is on course to change dramatically. It will be one in which state-sponsored currencies operate alongside sovereign assets like Bitcoin or Ethereum.

It’s far too challenging to identify how long these technologies can coexist, but that shouldn’t stop regulators and entrepreneurs from designing a better future beyond legacy finance.

You might also like: How much you might earn staking on Ethereum 2.0