Monero (XMR) Falls Back but Holds on Above Crucial Support

3 min readTable of Contents

Monero (XMR) has been struggling to regain its bullish momentum since reaching a high on Dec. 19.

However, the decrease only served to validate the breakout level and Monero is expected to move upwards once more.

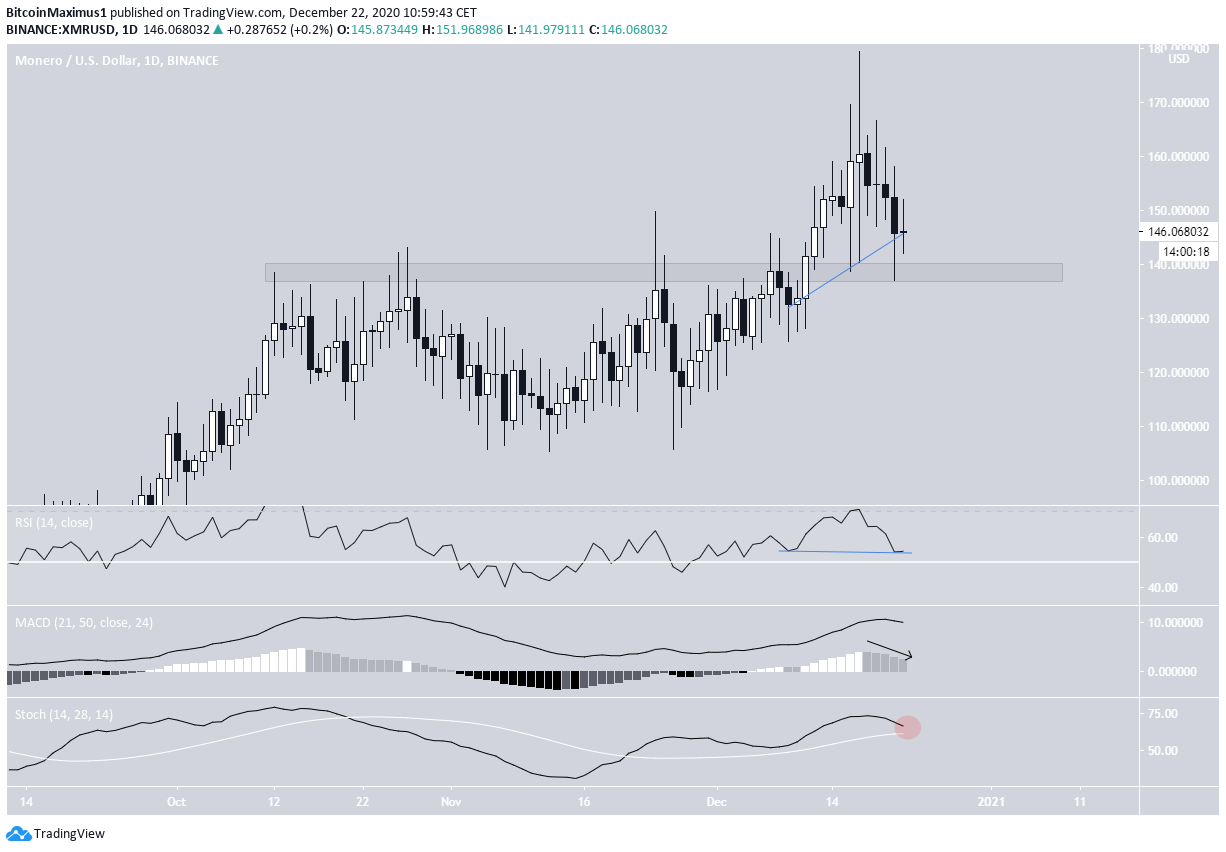

Monero Long-Term Movement

The weekly chart shows that XMR is trading between major support and resistance levels of $133-$166, created by the 0.382-0.5 Fib retracement levels of the most recent downward move.

XMR was rejected on Dec. 17 after reaching a high of $179. The downward movement that followed appears to be a re-test of the breakout level rather than the beginning of a new downward trend.

While the weekly RSI has generated some bearish divergence, it has not fallen considerably yet. Furthermore, neither the MACD nor RSI have turned bearish.

As long as XMR does not reach a close below the breakout level of $133, it is expected to continue moving upwards and eventually break out above $166.

If it does, the next significant resistance area would be found at $199, but XMR has the realistic potential to increase all the way to $308.

Cryptocurrency trader @sbravonqn outlined an XMR chart and stated that if it breaks out above the current level it’s likely to increase at an accelerated rate.

Daily XMR Movement

The daily chart also shows a resistance/support flip of the $140 area, which was validated yesterday in the form of a long lower wick. Furthermore, there is hidden bullish divergence in the RSI, a sign that an upward movement is expected.

On the other hand, the MACD is decreasing and the Stochastic oscillator is very close to making a bearish cross, providing mixed signals.

The six-hour chart shows that XMR is also following an ascending support line.

Even though there is a lack of sufficient bullish reversal signs, the numerous support levels just below the current price make it likely that XMR will bounce.

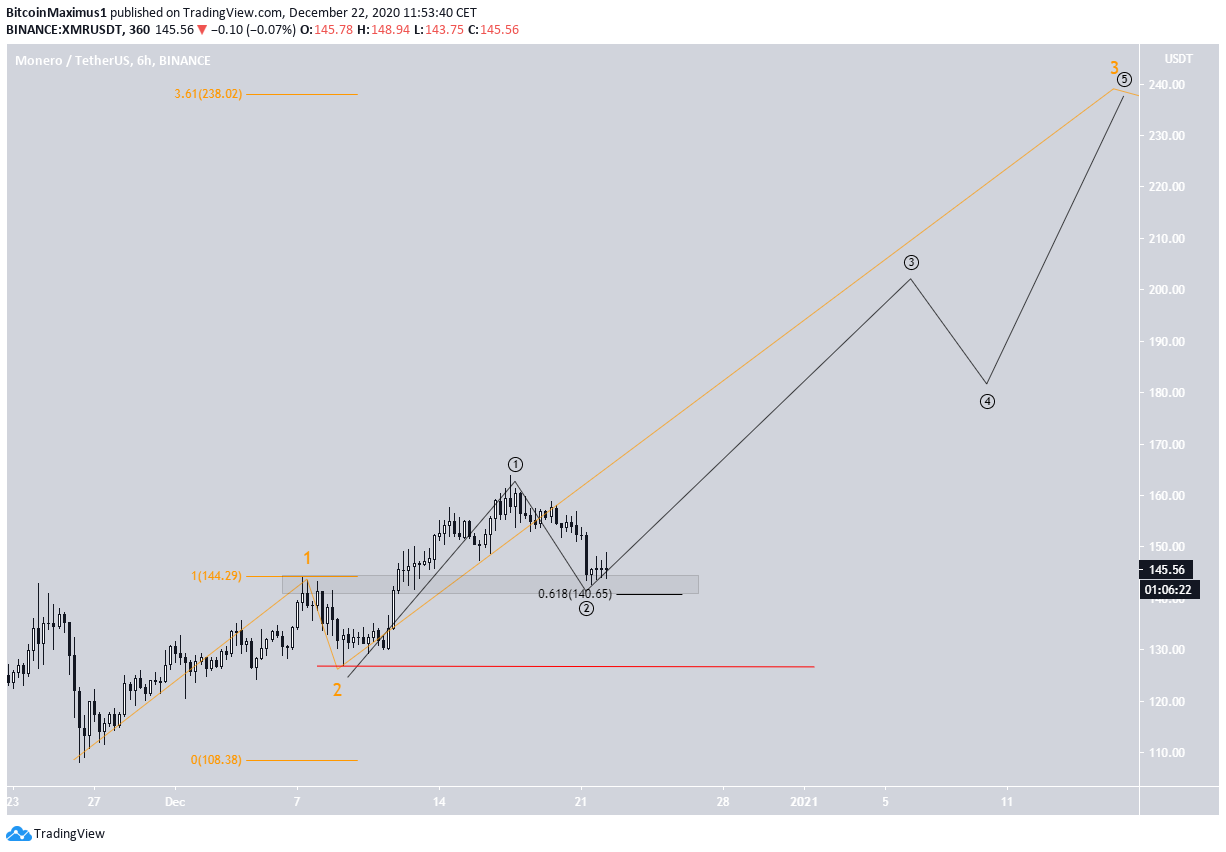

Wave Count

The wave count suggests that XMR has completed waves 1 and 2 (shown in white) of a bullish impulse that began in March. It has now likely begun wave 3.

A preliminary target for the top of wave 3 is found at $305, which would give waves 1:3 a 1:1.61 ratio — a common pattern in bullish impulses.

A closer look at the movement reveals that XMR has likely created a 1-2/1-2 wave formation, and is currently in an extended sub-wave 3 (orange). The minor sub-wave count is shown in black.

A possible target for the top of sub-wave 1 is found at $238. A decrease below the sub-wave 1 low (red line) at $127 would invalidate this particular wave count.

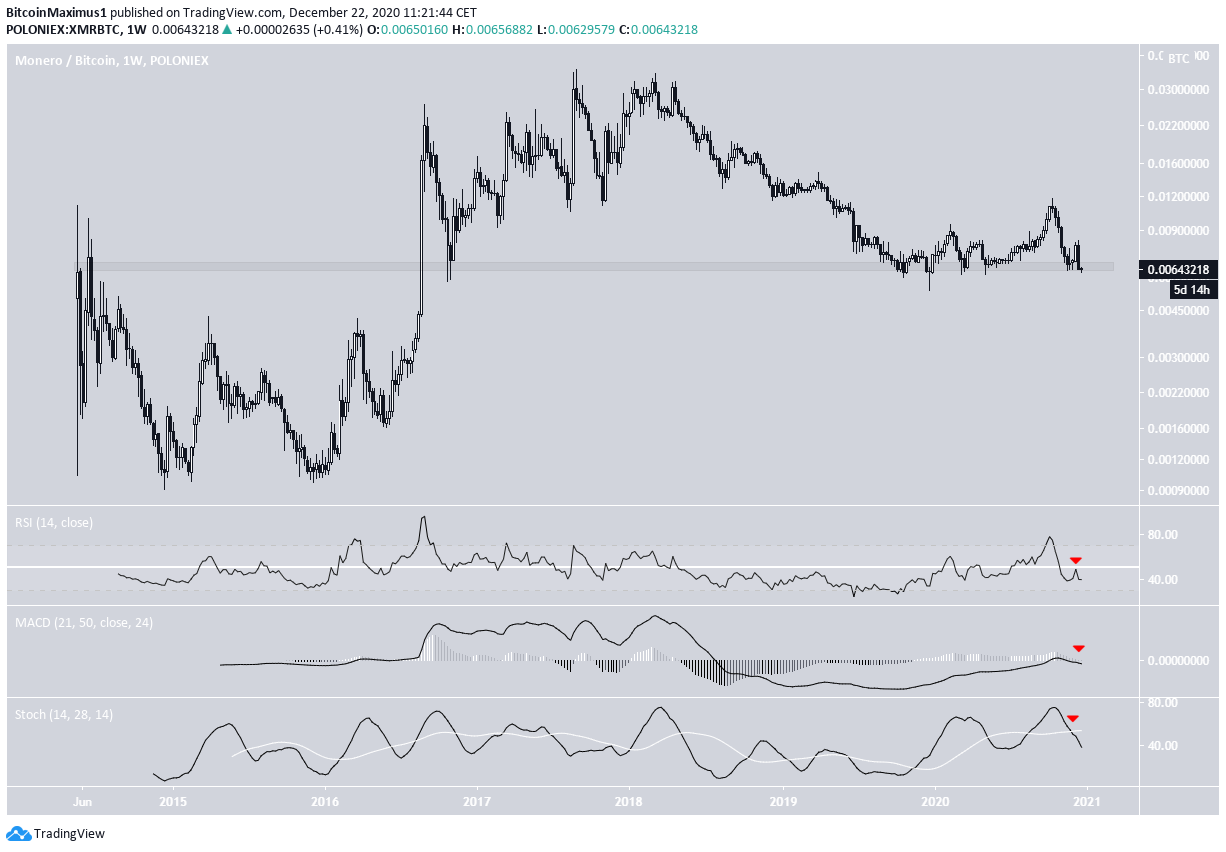

XMR/BTC

The XMR/BTC price is trading just above a crucial support level at ₿0.0065. It has not traded below this level since it first broke out on Aug. 16.

Despite this, there are no reversal signs. On the contrary, the RSI has fallen below 50, the MACD has fallen below 0, and the Stochastic oscillator has just made a bearish cross.

Therefore, it is possible that XMR will break down below this support area instead of bouncing, which could trigger a very sharp drop.

Conclusion

Monero (XMR) is expected to bounce at the current support area and resume its upward movement toward the range of $268-$305. A decrease below $127 would invalidate this scenario.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

The post Monero (XMR) Falls Back but Holds on Above Crucial Support appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 38 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)