Other bear markets will be shallower than 80%

2 min readThe tendency of Bitcoin (BTC) to decrease by more than 80% after the end of the bull run slowly ends. That’s according to a new report published by the California hedge fund Pantera Capital. The report states that recent periods of decline in primary cryptocurrency prices have been less severe than in the past.

BTC declines of 80% are a thing of the past

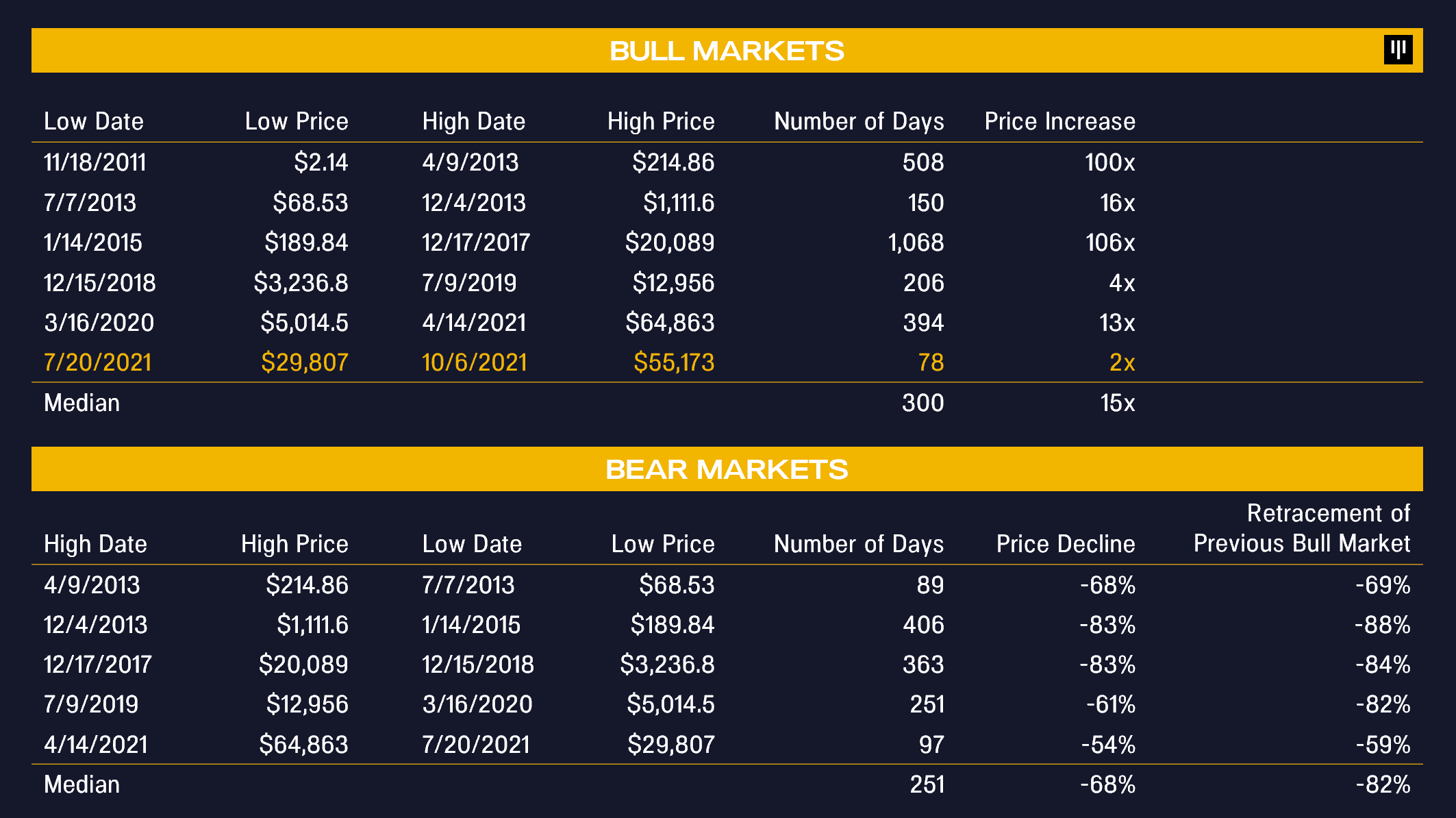

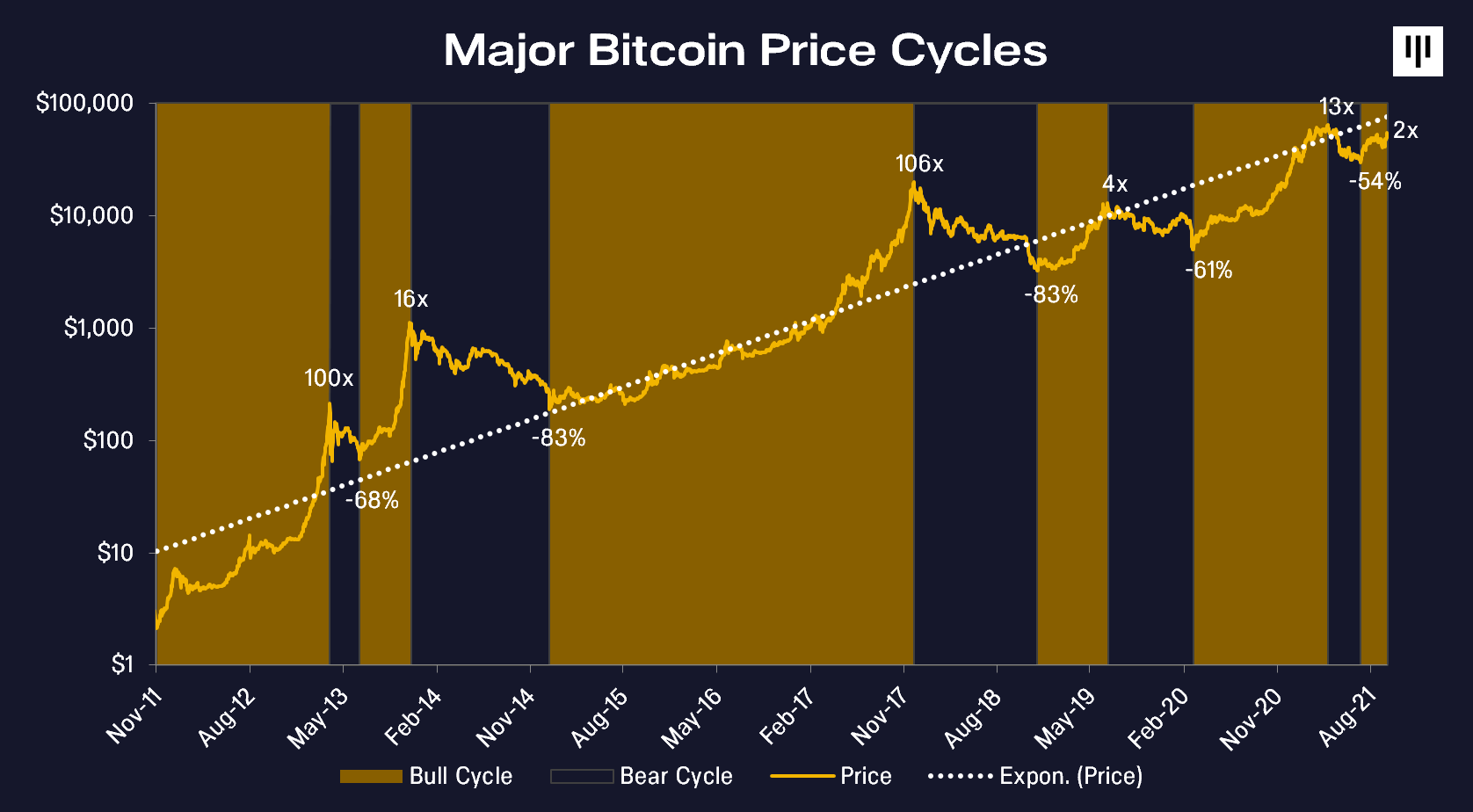

For example, in 2013-15 and 2017-18, BTC fell by as much as 83% after reaching nearly $ 1,111 and $ 20,089. Similarly, bull runs in 2019-20 and 2020-2021 led to massive price corrections. However, their retracements rates were -61% and -54%.

Dan Morehead, CEO of Pantera Capital, highlighted the consistent decline in sales sentiment after the 2013–15 and 2017–18 bear cycles, saying that future bear markets will be “shallower”. He explained:

“I have long believed that once the market becomes wider, more valuable and more institutional, the amplitude of price fluctuations will diminish.”

source: Pantera Capital

The statement came as BTC regained its bullish strength to retest its current record high of nearly $ 65,000. BTC has climbed above $ 60,000 for the first time since early May as the US Securities and Exchange Commission approves the first publicly traded fund (ETF) of BTC futures after years of rejecting similar investment products.

The approval of ProShare’s BTC Strategy ETF has raised expectations that this will make it easier for institutional investors to gain exposure to the BTC market. It also helped BTC erase almost all of the losses incurred during the April-July bear cycle as the price of BTC doubled to a level back above $ 60,000.

Post-halving rallies

$ 100,000 predictions are now increasingly being heard as BTC becomes a major financial asset after its first approved ETF.

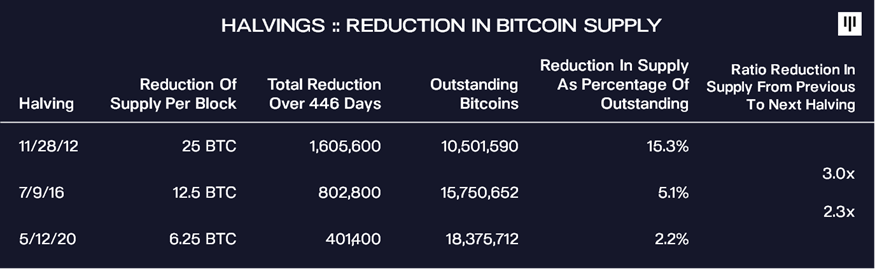

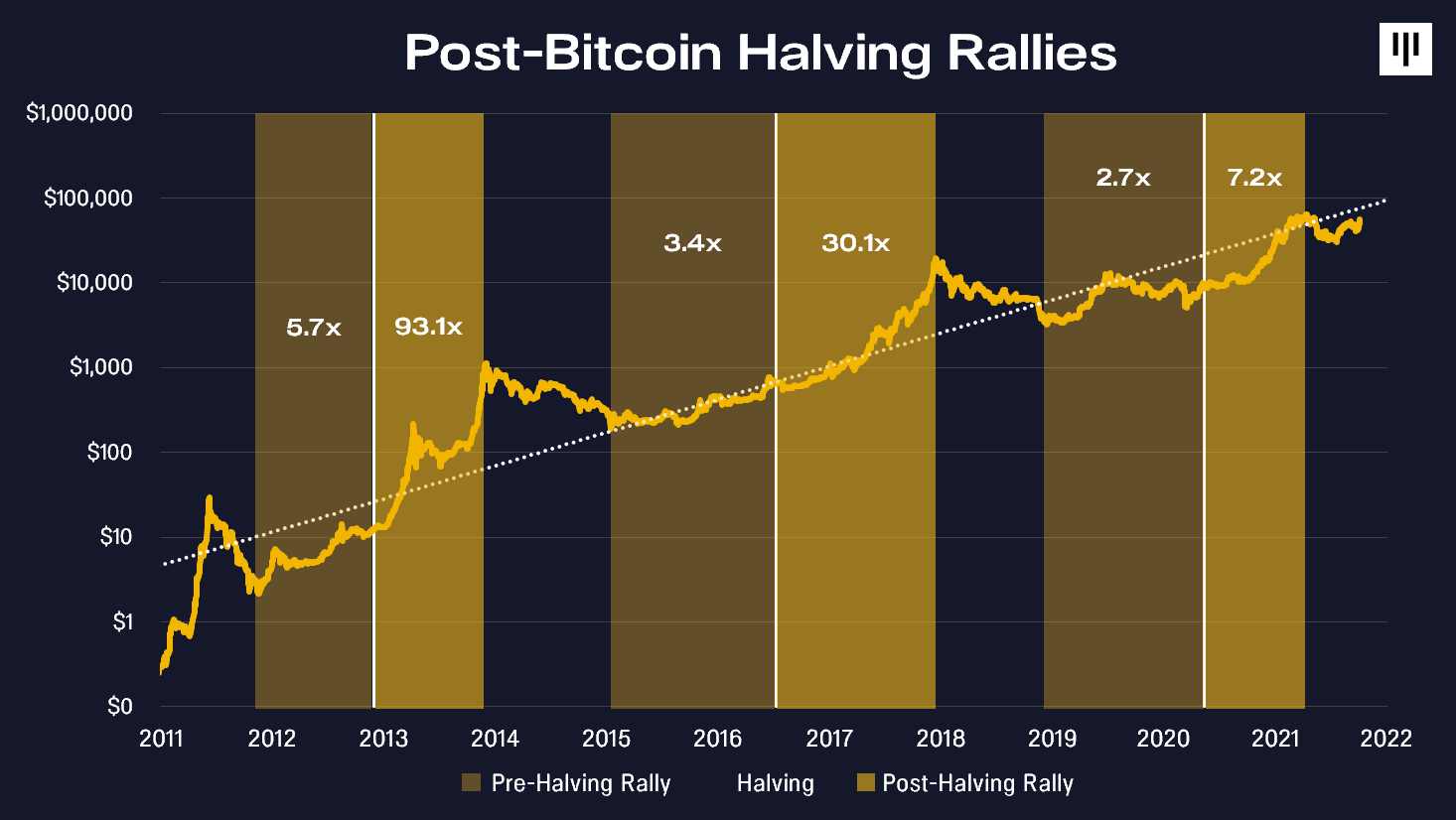

Morehead also mentioned a popular stock-to-flow model that studies the impact of BTC halvings on prices-in order to rule out a similar bullish outlook for cryptocurrency. He noted that the first halving reduced BTC’s new issue rate by 15% of the offer (approximately BTC 10.5 million), leading to a 9,212% increase in BTC’s price.

source: Pantera Capital

Similarly, the second halving reduced the supply of new BTCs by one third of the remaining supply (~ 15.75 million BTCs). This led to 2,910% of the bull run, which is almost a third of the previous one and shows a slightly smaller impact on the price of BTC. The last halving was on 11 May 2020, which further reduced the number of new BTCs, the price of which has since risen by more than 720%.

source: Pantera Capital

“We probably won’t see any further growth 100 times a year,” Morehead said.