QTUM, LIT & REN: Technical Analysis For March 9

3 min readA look into the current and potential price movements of QTUM, LIT & REN.

QTUM has broken out from a descending resistance line. Still, it is facing resistance at $5.65.

LIT has broken out from a descending resistance line. However, it was rejected by a horizontal resistance area afterwards.

REN is facing short-term resistance at $1.25. It is potentially trading inside a parallel channel.

Qtum (QTUM)

On Feb. 21, QTUM dropped sharply after attaining a high of $8.85. It reached a low of $4.24 two days later and bounced. It has been moving upwards since.

The bounce occurred right at the 0.618 Fib retracement of the entire upward move (white). It created a long lower wick, a sign of buying pressure. Afterward, QTUM broke out from a descending resistance line.

Technical indicators are bullish. The MACD has given a bullish reversal signal. The RSI has broken out above 50.

However, while the Stochastic oscillator is turning upwards, it has yet to make a bullish cross. The three previous crosses led to significant upward movements (shown with the green arrow in the image below).

The closest resistance area is found at $6.56 (black), just above the current price, followed by the February highs at $8.77. If a breakout were to occur, a potential target for the top of the movement is found at $11.63, using an external retracement (orange) on the most recent decrease.

Highlights

- QTUM has broken out from a descending resistance line.

- It is facing resistance at $6.56.

Litentry (LIT)

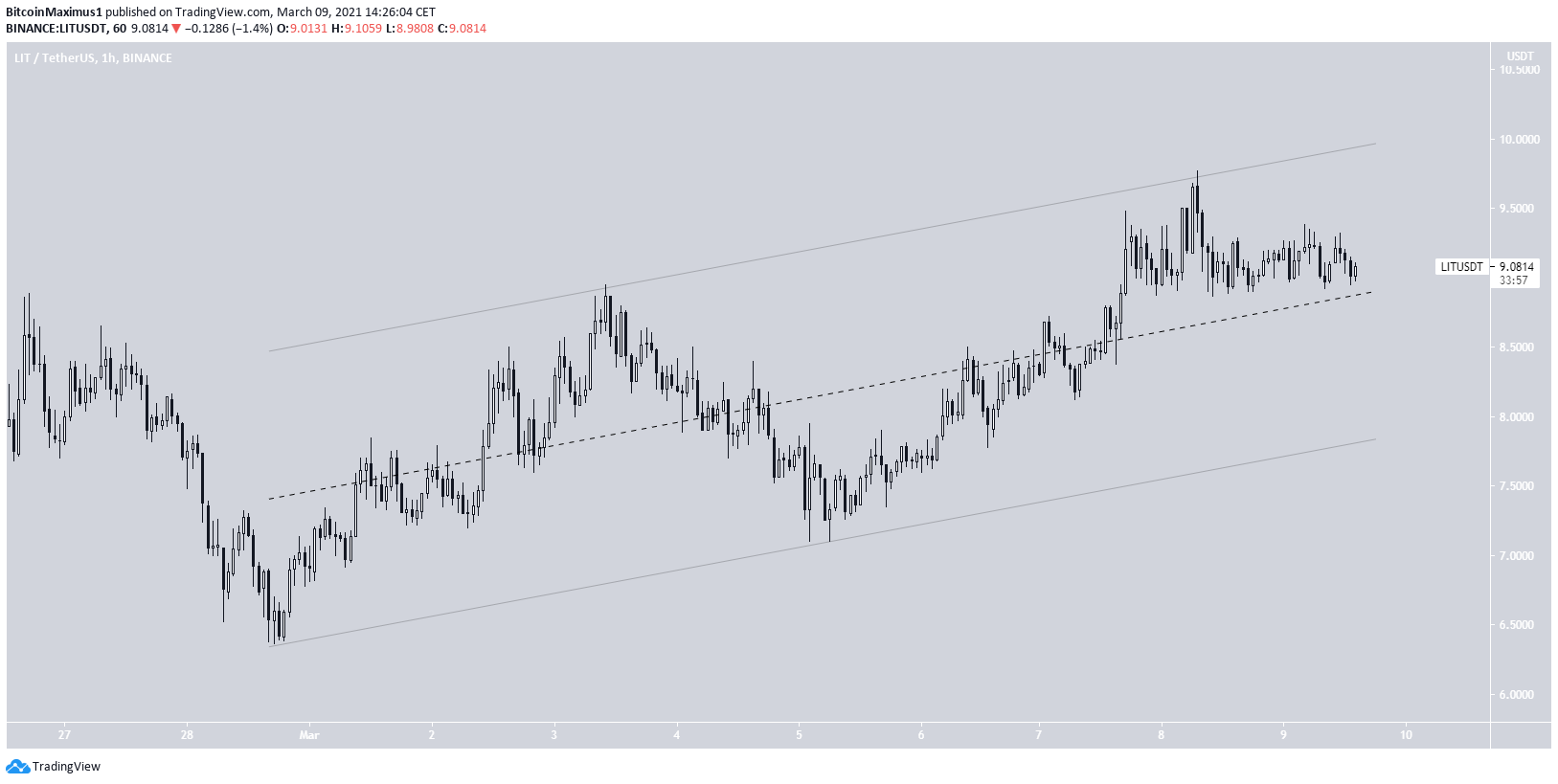

LIT has been decreasing since reaching an all-time high price of $14.78 on Feb. 16. The decrease stopped once LIT reached the 0.618 Fib retracement level at $5.84 on Feb. 23. It has been increasing since.

On March 2, LIT broke out from a descending resistance line. However, it was rejected by the $10 resistance area on March 8.

While technical indicators are bullish, both the RSI & MACD are showing weakness.

A closer look at the movement shows that LIT is trading inside a parallel ascending channel.

Movement contained inside parallel lines is often corrective. Furthermore, the resistance line of the channel coincides with the previously outlined resistance at $10.

Therefore, until LIT manages to break it, we cannot consider the trend bullish.

Highlights

- LIT has broken out from a descending resistance line.

- It is facing resistance at $10.

Ren (REN)

From Feb. 20 to Feb. 23, REN dropped from a high of $1.84 to a low of $0.88. This measured a decrease of 52%.

While REN has been increasing since the upward move has been weak. REN has yet to move above the 0.382 Fib retracement level of the most recent decrease at $1.25. having been rejected twice.

Furthermore, REN is potentially trading inside an ascending parallel channel. If the channel is confirmed, it would mean that this is likely a corrective structure, from which it would expect a breakdown.

Highlights

- REN is facing resistance at $1.25.

- It is potentially trading inside a parallel ascending channel.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post QTUM, LIT & REN: Technical Analysis For March 9 appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 29 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)