Retail FX Deposits Held at US Brokers Drop $13M in August

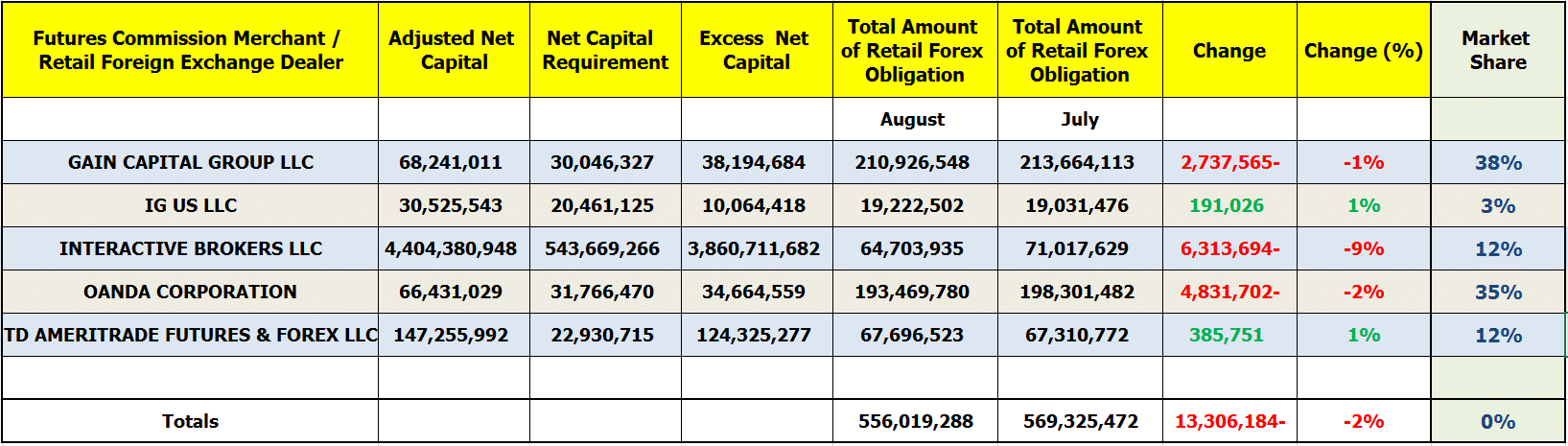

2 min readData from the US securities regulator for August 2020 shows that registered retail FX platforms lost more than $13 million in clients’ deposits, coming in at $556 million. The two percent drop came as trading activity surged in other segments amid a boom in retail investments during an unprecedented time for financial markets.

After consecutive increases in its market share, Interactive Brokers suffered a drop in retail deposits in August 2020. Specifically, the broker’s net balances decreased by $6.3 million, or nine percent, to $64.7 million. In contrast, the listed brokerage firm was the best performer in June, after recording an overall rise of $6.6 million, or nearly 10 percent month-over-month.

The Most Diverse Audience to Date at FMLS 2020 – Where Finance Meets Innovation

In September, however, the electronic brokerage segment at Interactive Brokers, which deals with clearance and settlement of trades for individual and institutional clients globally, experienced a rush of activity with volumes rising by 132 percent year-over-year and nearly 12 percent on a monthly basis.

Only two of the five FX firms listed notched slight increases in Retail Forex Obligations, this time was IG US, which saw its clients’ assets grow by $191,000, or nearly one percent from the prior month.

Suggested articles

Ensure Your Payments Are Safe and Secure with ShefapayGo to article >>

Other highlights from the CFTC’s monthly report shows that Nebraska-based TD Ameritrade has racked up $385,000 in additional deposits, which stood at $67.3 million in August 2020.

As a result, TD Ameritrade overtook the largest US electronic brokerage firm, as measured by DARTs, as the US third-largest holder of retail FX funds —something that happens a number of times as both companies duke it out for dominance.

Meanwhile in August, GAIN Capital saw a fall of nearly $2.7 million to $210 million. Retail funds at OANDA Corporation also plummeted two percent, or $4.8 million.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending August 31, 2020. For purposes of comparison, the figures have been included against their July 2020 counterparts to illustrate disparities.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)