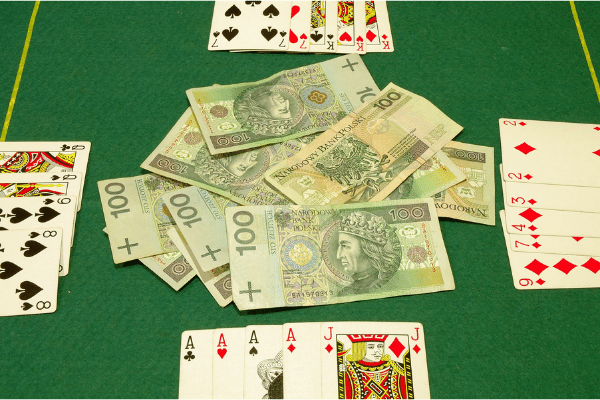

Should You Take Money Off the Table?

2 min read-

Conventional financial wisdom suggests taking profits regularly – but that’s because managers are often judged by the profits they make and not the ones they miss

-

Individual investors can consider reducing the number of bets, but putting plenty of work into each bet and sticking with them

So, you took a timely bet on Tesla (+6.36%) and now you’re sitting on some fine paper profits – should you be taking some of the money off the table and bringing the family to the Poconos?

Conventional wisdom in the financial industry says that it’s never wrong to take a profit – in fact a client is unlikely to be unhappy or indeed even notice if you sell an asset that has subsequently gone up significantly (except maybe for Bitcoin), because the loss of foregone upside is not captured in performance data, but downside is.

The temptation therefore for managers is to lock in results, especially if they have beat projections, rather than to keep chasing upside, but is this sound advice for individual investors as well?

Maybe not.

For clients, investing is asymmetric – the upside of not selling is nearly unlimited (theoretically) while the downside is naturally capped – for the client, it can be wrong to take profit and to do so often, because the data shows that when individual investors increase their velocity of trading, they tend to underperform investors who did very little.

Research by Hendrik Bessembinder, a professor at Arizona State University has found that nearly 60% of global stocks over the past 28 years did not outperform the U.S. one-month Treasury Bill.

But Bessmbinder’s research also revealed that about 1% of companies accounted for all the global net wealth creation – it’s why company founders very seldom relinquish their shares.

With as much as 99% of companies just a distraction from making the serious money, investors need a vastly different mentality when it comes to investing – focusing on the possibility of extreme upside, and not the crippling fear of a somewhat capped downside.

Bessembinder made it clear that it was the long term compounding of superstar companies’ share prices that mattered most, with investing requiring patience to deal with the inevitable ups and downs that such companies experience as well as the ability to delay significant gratification.

But what about GameStop (+18.34%) then?

Had an investor bought at a high, they’d now be sitting on a pile of paper losses.

Therein lies the difference, GameStop was not an example of a company that Bessembinder’s research was considering, instead it advocates a more Warren Buffett-esque approach to investing – mountains of copious study, few investments, and sticking with them.

The post Should You Take Money Off the Table? appeared first on SuperCryptoNews.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)