Tokenized Bitcoin Reaches More than $110 Million

2 min readThere are now more than $110 million worth of tokenized bitcoin running on the ethereum network for the first time ever. Meaning the second biggest network, eth, now holds 10x more bitcoins than bitcoin’s own Lightning Network which has just under $10 million. WBTC and similar tokens represent Bitcoin on the Ethereum blockchain. One tokenized BTC equals one “regular” BTC; Bitcoin can be converted into these tokens, and vice-versa. To achieve this, users lock up their BTC on the Bitcoin blockchain using specialized custodian services or smart contracts.

Majority of it is in wBTC, the defi consortium run bitcoin tokenization on ethereum’s network. That has been growing with speed, up $5 million in just one day to now reach $87 million just by itself.

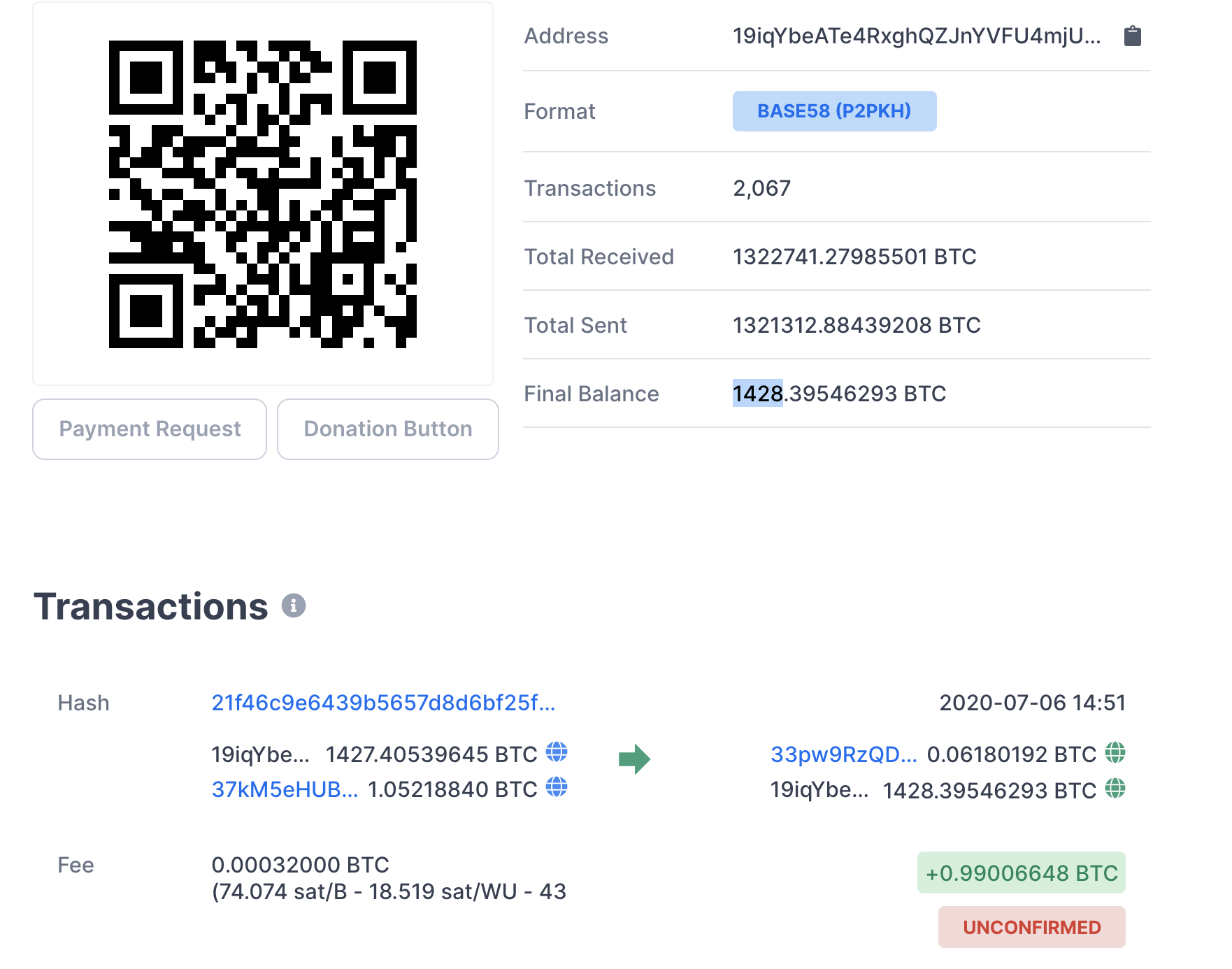

Then there’s RenBTC, a decentralized way to tokenize bitcoin on the ethereum network that currently hold 1,428 bitcoins, worth $13 million.

Ren may have contributed to the fast rise of wBTC as the two can be exchanges on the Curve ren pool where they give a considerable interest rate for the deposited bitcoins.

There are also other smaller tokenized bitcoin projects. The third, fourth and fifth places are occupied by HBTC, imBTC and sBTC, accounting for 710 ($6.45 million), 608 ($5.53 million) and 512 ($4.65 million) tokenized Bitcoin, respectively. Other tokens amount to nearly $350,000 worth of Bitcoin or less.

So in total there is more than $110 million btc running on eth

DeFi driving tokenized Bitcoin adoption?

One of the main reasons for the surge in tokenized BTC is likely down to the growth of decentralized finance (DeFi) applications.That btc can now access the entire ethereum defi space, including flashloans with just recently someone borrowing $30 million worth of assets, including wBTC, at the total cost of just $100.

You can also atomic swaps as they like to call it in bitcoin, but on eth it is a lot more integral, a lot smoother and with a 21st century level of convenience. You can also margin trade, options, even buy stocks on synthetix platform and it is all actually code.

There is no order book for many of these broker like exchanges, instead there are code based liquidity pools. For the Synthetix, there is no custodian to keep the peg, instead there are tokens deposits and algorithms that makes it all run in a decentralized way.

Since Bitcoin doesn’t have the DeFi infrastructure that allows Ethereum token holders to lend their assets and receive passive yields, it appears that Bitcoin holders are turning to wrapped BTC tokens in order to use their assets in the rapidly growing DeFi market.

You might also like: NFT token sales hit $100 million as virtual economy booms

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)