Trading in stablecoins reaches new maximum levels

2 min read

When the concept of stablecoins was first introduced to the world, there was a stormy period in the crypto industry. Trading was moving faster, liquidity increased and markets became more efficient. The introduction of stablecoins allowed users to make crypto currency payments without the risk of volatility.

Although stablecoins have changed the way the crypto markets work, there have been a number of disputes over the last few years. Financial regulators also viewed this asset class skeptically, raising numerous concerns about their potential economic impact.

However, none of this is an obstacle to the use of stablecoins

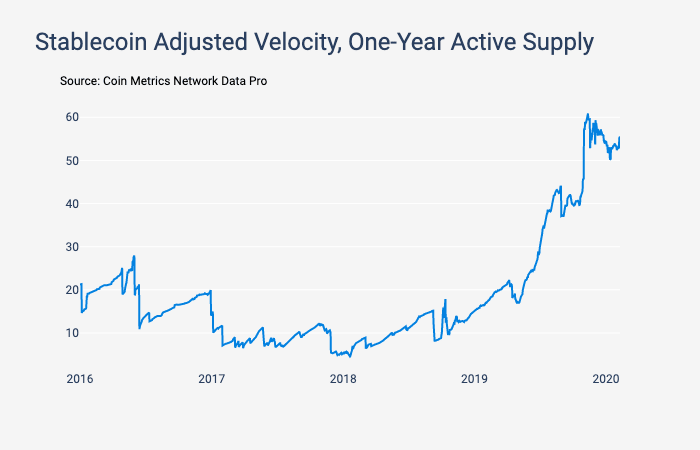

According to a report from CoinMetrics, the rate of one-year active supply of stablecoins is close to its historic maximum. Speed generally represents how often an asset changes ownership, which essentially means that market participants are increasingly trading stablecoins.

The CoinMetrics chart also shows that growth began in early 2018. However, the metric accelerated even more after mid-2019.

New projects support growth

This is related to the fact that many new projects were launched last year. In addition, Tether, the most dominant stablecoin on the market, was released last year on the blockchain Ethereum, a development that probably contributed further to the increase. According to CoinGecko’s annual report, Tether had a dominant market position of 82% in 2019. According to the ConsenSys report, projects in 2019 showed more than $ 1 billion in funding for stablecoins, supported by Tether.

One of the largest cryptocurrency exchanges in the world, Binance, also launched stablecoin with USD – BUSD support last year. Given the volume of trading that takes place on the platform, this probably also contributed to an increase in the speed of these coins, as Binance users have a much greater incentive to trade with BUSD than with other fiat-bound cryptocurrencies.

In addition, it was recently announced that more than $ 1 billion was locked in decentralized funding (DeFi), of which MakerDAO was approximately 60%. This increase in the use of DAI-linked on ETH further confirmed the increased use of stablecoins over time.

Summary

Despite a number of concerns about stablecoins and their potential impact on the crypto markets and the world economy, it is clear that they will remain and are likely to continue to be used with an increasing tendency.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)