Tron’s Algorithmic Stablecoin, USDD Officially Launched

3 min read

In late April, Tron founder Justin Sun unveiled USDD, the network’s first algorithmic stablecoin. About 15 days after the announcement, the stablecoin finally started trading on Wednesday (4).

Within hours of launch, USDD already had its yield pools running on Binance’s network, BNB Chain. According to Ellipsis ad the pool offers up to 59% returns for those who stake USDD.

DAO and transparency

In addition to the launch of USDD, there was the launch of Tron DAO Reserve (TDR), a decentralized organization that will ensure the development of the stablecoin. The system also has a kind of stablecoin transparency portal, containing the amount of USDD issued.

Number of USDD issued and TRX burned. Source: Tron DAO.

This difference is caused by the way the stablecoin is created. This minting is done through institutions registered on the TDR waiting list. To create USDD, institutions need to leave TRX on a Burning Contract.

TDR then calculates the dollar value of the TRX based on the prevailing exchange rate and transfers a dollar amount equivalent to TRC10 USD.

In the next pass, the TRC10 USD is converted into TRC20 USD, a process that generates the USDD units. Finally, the amounts of the stablecoin are sent to the institutions’ wallets.

As per the website data, there are around 116 million USDD in circulation as well as a burn of 1.5 billion TRX tokens. The stablecoin registered $7.4 million in volume, up 341% on its first day.

Dynamics of stability

USDD also has a dynamic that aims to preserve the stablecoin’s parity with the US dollar (USD). In this sense, to keep the price stable, when the USDD price was less than 1 USD, users and arbitrageurs can send 1 USD to the system and receive 1 USD in TRX.

On the other hand, when the USDD price was over 1 USD, users and arbitrageurs can send 1 USD in TRX to the decentralized system and receive 1 USD.

This exchange system between USDD and TRX is similar to the one used by Terra to maintain the value of the UST against the dollar. In fact, the competing stablecoin was one of the inspirations that led to the development of USDD.

TDR will automatically replenish the authorized contract reserve when your USDD reserve is less than 500 million.

The network will have an additional layer of protection through multi-signature. USDD will be locked for at least 10 days in a wallet with seven signatures. It will be unlocked after the transaction has received at least five of the seven signatures.

Tron breaks DeFi records

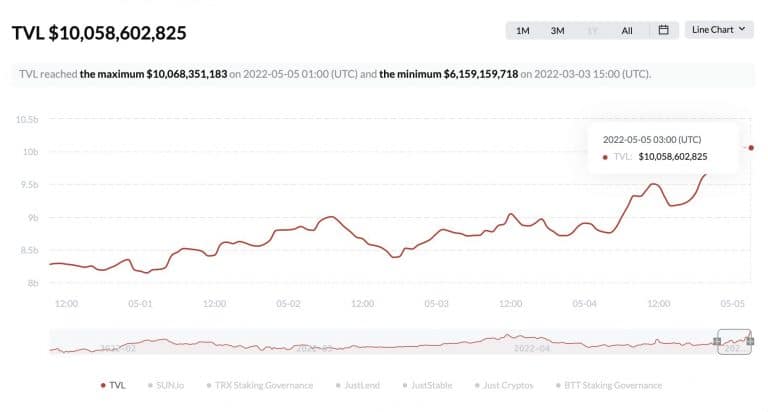

With the launch of the stablecoin, Tron broke a record in the inflow of funds into its decentralized finance (DeFi) apps. According to TRONScan, the total amount allocated to the network (TVL) has surpassed the $10 billion mark.

TVL record on the Tron network: Source: TRONScan.

Part of this increase was likely caused by USDD’s interest rate policy. According to the stablecoin white paper, TDR will set its risk-free prime rate at 30% per annum. In other words, an excellent future income.

World’s First Pay-to-Live Crypto Building Launches in Argentina