US bank BNY Mellon blames “no exposure to BTC” for fund underperformance

3 min readUS bank BNY Mellon says one of its technology-focused funds had underperformed the market because it wasn’t exposed to companies investing in BTC, a filing from yesterday showed.

As of the second quarter of 2020, BNY Mellon is the world’s largest custodian bank and asset servicing company, with over $2.0 trillion in assets under management and $38.6 trillion in assets under custody.

But the bank has missed out on the crypto bandwagon and is lamenting. “Fund performance was hurt as well by a decision not to own MicroStrategy, whose stock surged when it announced it had invested in BTC,” the filing read.

In a filing today, BNY Mellon said the performance of one of its investment funds was hindered by lack of exposure to BTC:

"Fund performance was hurt as well by a decision not to own MicroStrategy, whose stock surged when it announced it had invested in BTC."

The…

— MacroScope (@MacroScope17) April 28, 2021

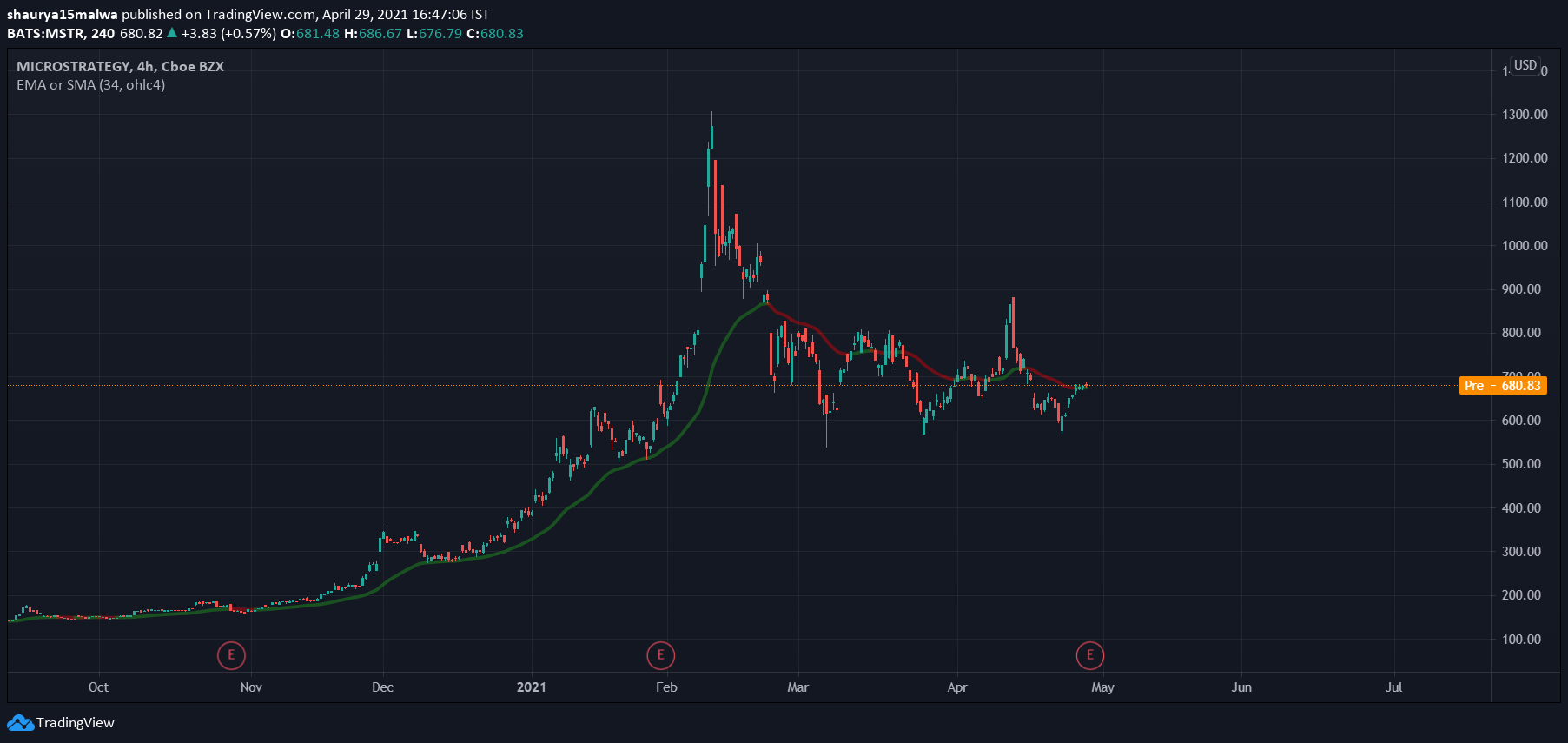

The stock of business analytics firm MicroStrategy—the firm has picked up billions of dollars worth of BTC in the past year—has been increasingly lauded by pundits as a pseudo-BTC exchange-traded fund (ETF) in the past year.

ETFs are regulated financial instruments that track the price of a given asset/s and can be traded/invested in a similar manner as individual stocks. Firms have long tried for a BTC ETF in the US, but the government has continued to deny their listing, causing some traders to bet on MicroStrategy as a pseudo-BTC ETF instead.

The price action is uncanny. MicroStrategy stock surged by over 40% in the days after announcing its first BTC purchase in mid-2020. It’s since posted nearly 10x gains—reaching a high of $1,269 in February 2021—and has been mirroring BTC’s price movements

Meanwhile, BNY Mellon further noted being underweight in the regional banking industry whose stocks provided superior returns to investors as the US government increased interest rates and the broader financial service sector gained investor confidence as the COVID-19 vaccine was rolled out.

It did, however, say a position in a gold mining company ending up hampering performance. “As for stock selection, a position in Alamos Gold, a gold mining company, hampered performance as shares were hurt by weak gold prices,” the firm said.

Banks turning to crypto

BNY Mellon is one of the many US banks that have turned a new leaf to BTC in the past few months. The bank—in terms of being ‘crypto friendly’—joined the likes of Goldman Sachs, Morgan Stanley, and JPMorgan in February after stating it would hold, transfer and issue BTC and other cryptocurrencies on behalf of its asset-management clients.

The bank’s chief executive of asset servicing Roman Regelman even said at the time that “digital assets were becoming part of the mainstream” and that the bank would service client needs accordingly.

As such, BNY Mellon isn’t entirely new to the crypto space. In 2019, the bank became one of the first US financial institutions to publish a report on the then-crashed market—stating decentralized exchanges were positioned as a unique market fit.

The post US bank BNY Mellon blames “no exposure to BTC” for fund underperformance appeared first on CryptoSlate.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)