Why do Americans “pour” cash from support checks into Bitcoins and gold?

2 min readAmericans seem to like Bitcoins and other cryptocurrencies, two recent reports suggest.

The US bank JPMorgan said yesterday that younger investors would “choose Bitcoins” as their investment, and a report from last week stated that Americans are investing their “excess” cash in cryptocurrencies. Both reports suggest the same result: in times of economic uncertainty, adoption increases cryptocurrently.

Americans are investing more in stocks, Bitcoin and gold

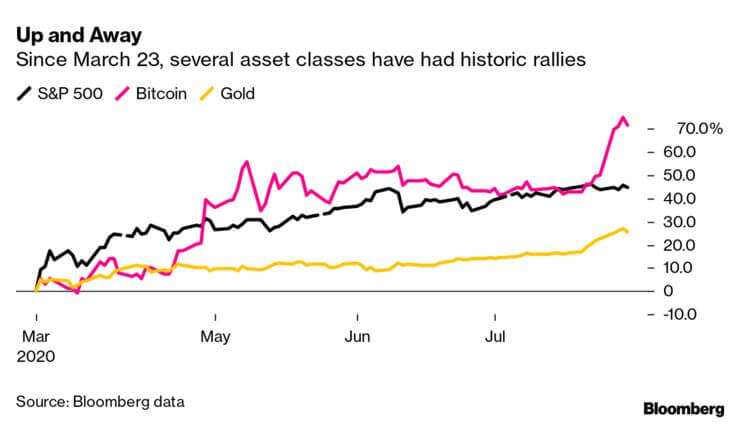

Falling interest rates are encouraging some Americans to give up security and invest their savings in assets such as stocks and Bitcoins, Bloomberg said. The move comes as traditional valuations – such as low-interest bank accounts – lose their relevance as “risky” assets provide massive returns.

There is standard advice on Reddit and Facebook groups for people to keep cash in high-yield savings accounts. However, rates on them have been steadily declining over the last year.

Ally and Marcus – a subsidiary of Goldman Sachs Group Inc. – in July it gave investors only 1% and 1.05% (while DeFi projects such as Yearn Finance 1,000%). Both cut interest rates from last year’s 2% after the US Federal Reserve cut rates for the first time since 2008.

For most investors, however, this means very little profit, which is absorbed by the adverse effects of inflation. In contrast, assets such as Bitcoin and gold showed returns of 55% and 29% this year, while Ethereum, Chainlink and some DeFi tokens provided at least 300%.

Younger ones go for crypto

JPMorgan analyst Nikolaos Panigirtzoglou said in a report Wednesday that younger investors are generally interested in alternative assets like Bitcoin.

Millennials are embracing stocks, particularly technology shares, whereas older individuals are selling equities, the report noted.

Older generations continue to use bonds as their favored instrument for excess liquidity, evidenced by their “strong buying” during both June and July.” The analyst referred to investment flows for their report.

Gold and Bitcoin ETFs have been experiencing strong inflows over the past five months, as both old and young see the case for an “alternative” currency, added Nikolaos.

However, that’s not to say older generations are not warming up to Bitcoin. Earlier this year, investing legend Paul Tudor Jones said his $22 billion Tudor Investments firm holds over 1% of total assets in Bitcoin futures.

And with the current economic climate of over-inflation and excessive money printing: Choosing crypto seems a lot natural.

You might also like: These Are the Most Rewarding Bitcoin Faucets in August 2020

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)