4 Things That Could Cause the DeFi Bubble to Pop

6 min readTable of Contents

The DeFi market is growing at an exponential rate. Here are 4 things that could pop the bubble.

The market for decentralized finance (DeFi) solutions has skyrocketed in the past four months as investors are happy to stake their cryptocurrency in various lending protocols to earn astronomically high returns.

Back in March this year, the total value locked in protocols of the kind was just about $550 million. Now, the TVL has surged to just shy of $9.5 billion, marking an increase upwards of 1600%.

The trend, commonly referred to as yield farming is only growing stronger as more and more protocols are popping by the day and investors rush to stake their money.

Most recently, developers are creating various meme-based protocols with food-related reward tokens such as YAM, SUSHI, PASTA, KIMCHI, and whatnot, that attract millions and even billions of staking value in a matter of hours.

They usually provide tremendously high returns but most of them come with unaudited smart contracts where the developers openly warn of the risks involved. Still, people are happy to pour their money in.

Regardless of anything else, the exponential growth displays bubble-like characteristics and we’ve taken the liberty of outlining at least four scenarios that could halt it.

Smart Contract Failure

One of the inherent risks of investing in cryptocurrency protocols of any kind, DeFi included, is the non-zero chance of failure when it comes to the smart contract code. This was discussed at length last year at the Ethereal Summit in Tel Aviv.

This is true for audited and carefully examined protocols, and it’s even more true for unaudited smart contracts where all the rage is right now.

Some of the most popular DeFi protocols in the past few weeks are Yam Finance, Spaghetti Money, SushiSwap, and most recently – Kimchi Finance. Yes, you’re reading it right – for some reason the meme power is strong with the community and most of the hottest DeFi protocols take after well-known meals.

Besides attracting billions in total value locked, all these protocols share one thing in common – they are not audited. This means that the developers released them and there were no third-party auditing companies or teams verifying the legitimacy of the smart contract code and whether or not there are any hidden issues that might be devastating for the investor.

Yam was the first protocol that saw a critical error in its code – a mistake that caused the entire thing to be completely ungovernable and rendered the “experiment” a temporary failure. As a result, the price for YAM – the governance token of the protocol, tanked, leaving everyone who bought it at a loss. There were also serious risks for people who were staking at the time. The team has since moved to rectify the damage and there’s a new plan already in place, but YAM’s case displayed first-hand what damages a critical error could do.

The silver lining was that the liquidity provided in the pools wasn’t at risk, but this doesn’t change a thing.

An inherent smart contract code error related to liquidity provision in unaudited protocols that ends up draining millions, if not billions, of liquidity, could be absolutely catastrophic for the DeFi field altogether.

Going forward, there are projects out there that are intentionally deceitful and their creators aim at nothing but to scam investors out of their money. There are millions worth of ETH already lost to Uniswap rug pulls. However, if this happens at scale and there are billions lost at once in a single scheme, it could pop the entire bubble in an instant, as confidence could be entirely obliterated.

Hacks and Exploits: A Real Concern

They say that the best way to predict the future is to learn your history.

Well, back in April, a hacker managed to drain $25 million of the total locked value in a Chinese decentralized finance protocol backed by Multicoin Capital called dForce Network.

Now, imagine this happening to a protocol such as SushiSwap that currently has more than $1 billion in total value locked and, get this, is completely unaudited.

Hacks have been a threat to the entire cryptocurrency field since its inception. Unlike centralized solutions such as Binance, Coinbase, BitMEX, and so forth, which usually have an insurance policy in place to protect their users in situations like these, most of the currently trending DeFi protocols are entirely anonymous and unprotected. We don’t know who’s behind the source code, let alone consider insurance.

That’s the main reason for which they also come with massive disclaimers, prompting people to use them at their own discretion. Yet, investors seem to be more than happy to put billions in high-risk protocols with no security measures in place.

At the time of this writing, there hasn’t been a major hack or exploit, but if history is any indicator, it’s probably a matter of time. We hope we are wrong on this one, but if history is any indicator, it’s important to stay vigilant.

Ethereum Transaction Fees

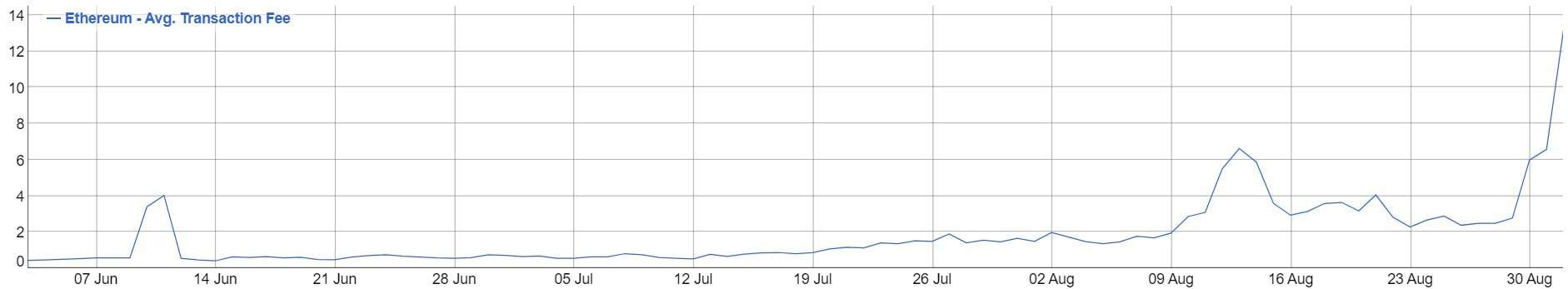

The bulk of DeFi-related transactions and operations take place on Ethereum’s network. The results are already here – sky-high transaction fees.

ETH fees are consistently charting new all-time highs, leading many to support the notion that DeFi will soon (if not already) be a privilege reserved only for the wealthy.

Indeed, many users are reporting cases where they have to pay a fee in the range between $50 and $120 for a simple staking operation. This will inevitably render retail investors unprofitable and leave high-yield opportunities for people with serious capital.

As the 2017 ICO bubble, the current DeFi market is certainly reliant on retail interest to some extent. More and more people are jumping on the hype train to make easy gains by purchasing the “next big DeFi coin” that will pull off a 10-50x overnight. It’s one thing to pay $5 for a $100 transaction, but it’s entirely different ball game to pay $50 for a $100 transaction.

Huge Move in Bitcoin’s Price

Last but not least, we need to consider Bitcoin. The primary cryptocurrency has been losing its dominance over the market in the past couple of months.

This is because DeFi coins and other large-cap altcoins have been popping in value. However, if one thing is clear in this space, it’s that when Bitcoin goes parabolic, the entire market takes a knee.

A sudden spike in the price of Bitcoin could cause massive FOMO amid retail investors, as the one we saw back in December 2017. And while DeFi is far too technical for the average Joe to jump on, Bitcoin is most certainly not. There are multiple ways the average person can purchase BTC and snowball its price to new all-time highs.

It’s also worth noting that many investors are well-aware of all of the above risks. As such, it won’t be much of a surprise if there comes a time when they’d like to put their DeFi profits in something much more reliable. Bitcoin does sound like the most probable choice.

Conclusion

All things considered, the DeFi market is currently booming and it doesn’t show any signs of slowing down.

Yet, for the most part, a lot of the trending protocols seem particularly risky and one boom-and-bust could be all it takes for the cycle to reverse.

Of course, there are many reliable and well-managed protocols such as Compound, Maker, Balancer, and so forth, that are likely to spearhead the field’s development going forward. However, as trust is one of the most important factors, a single misstep might be all it takes to rock the boat.

You might also like: Top Airdrops You Should Look Out for in September 2020

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)